Trump’s Announcement Sparks Billions in Gold and Silver Losses

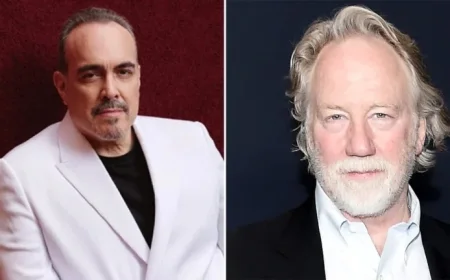

A recent announcement from President Donald Trump has caused a significant downturn in gold and silver prices, leading to billions in market losses. This drastic change took place shortly after Trump nominated Kevin Warsh to head the Federal Reserve, prompting reactions from investors and market analysts alike.

Trump’s Nomination of Kevin Warsh

Trump’s announcement, made on a Friday morning, reshaped expectations about U.S. monetary policy. Warsh, known for his free-market views and inflation hawkishness, diverges from the current Federal Reserve leadership’s approach. His economic philosophy, influenced by Milton Friedman, emphasizes that excessive money printing drives inflation.

Market Reactions and Impact on Precious Metals

The news triggered immediate and drastic changes in the precious metals market. Prior to the announcement, gold and silver prices had experienced a remarkable rally. However, as soon as Warsh’s nomination was confirmed, investors swiftly sold off their holdings in these metals.

- Gold experienced its worst selloff since 2013.

- Silver posted its largest one-day decline since 1980.

This sudden volatility shocked many investors, particularly retirement-age individuals who traditionally view gold as a secure asset amid inflation concerns. The substantial decline raised uncertainties about how ongoing policy changes might affect market stability.

Future Considerations for Investors

The implications of Warsh’s potential leadership extend beyond immediate market fluctuations. His preference for tighter monetary policies may result in higher interest rates, which historically strengthen the U.S. dollar. As the dollar strengthens, the attractiveness of gold and silver often diminishes, driving further selling pressure on these assets.

Nevertheless, long-term demand for gold remains somewhat stable, bolstered by foreign central banks, including China. These nations are increasingly diversifying their reserves in light of geopolitical tensions and a desire to reduce dependency on the U.S. dollar.

As markets brace for Warsh’s approach and its impact on Federal Reserve policies, investors should remain vigilant about further developments and their potential effects on gold and silver prices.