TrumpRx Offers Drug Discounts: NPR

The recent launch of TrumpRx.gov marks a bold initiative by the Trump administration aimed at lowering prescription drug costs for American consumers willing to pay cash instead of relying on health insurance. In a concerted effort to negotiate better pricing with pharmaceutical companies—namely AstraZeneca, Eli Lilly, EMD Serono, Novo Nordisk, and Pfizer—the administration has unveiled a platform that offers discounts on 43 brand-name drugs. Yet, beneath the surface lies a complex interplay of strategic motives, stakeholder implications, and ongoing regulatory debates.

Strategic Underpinnings of TrumpRx.gov

This program serves as a tactical hedge against mounting dissatisfaction regarding healthcare affordability in the US. By allowing consumers to bypass government insurance programs like Medicare, the administration seeks to mitigate criticisms about escalating drug prices. President Trump asserted during the launch event that this initiative is “the biggest thing to happen in health care, I think, in many, many decades,” projecting a narrative of governmental action against pharmaceutical overpricing. However, the strategic move raises several questions about accessibility and effectiveness.

Hidden Cost of Cash Payments

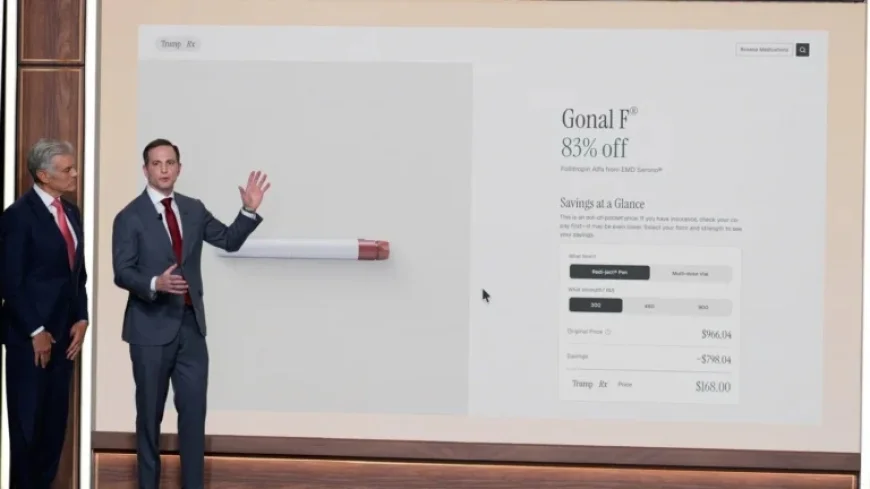

With discounts reaching up to 93% on certain drugs like Cetrotide, the allure of cash payments via TrumpRx does not come without caveats. Consumers must affirm that they are not enrolled in a government insurance program and will not seek reimbursement—essentially locking many patients out of potentially more affordable options. Clinicians, including Dr. Ben Rome from Brigham and Women’s Hospital, caution that for most insured patients, co-pays will likely remain cheaper than the cash prices provided on TrumpRx. The initiative appears more advantageous for those without insurance coverage or those requiring drugs typically not covered by standard plans, such as infertility or obesity treatments.

The following table highlights the impact on various stakeholders pre- and post-launch of TrumpRx.gov:

| Stakeholder | Before Launch | After Launch |

|---|---|---|

| Consumers | Limited access to affordable brand-name drugs through insurance | Access to cash discounts for select drugs |

| Pharmaceutical Companies | Pressure to lower prices without direct consumer sales | Opportunity for brand loyalty and direct consumer sales |

| Insurance Providers | Predominantly handling drug reimbursements and co-pays | Potential loss of market share as consumers may opt for cash payments |

| Government | Criticism over drug pricing and healthcare affordability | Claiming proactive healthcare measures, yet facing legality scrutiny |

Wider Implications for the Health Care Landscape

The rollout of TrumpRx.gov resonates with global economic trends, as countries grapple with healthcare affordability and pharmaceutical pricing. As regulations tighten around drug price disclosures globally, the US finds itself navigating a unique paradigm where drug pricing and insurance remain intertwined yet increasingly volatile. The ripple effect extends beyond the United States; Canada, the UK, and Australia are known for their stringent healthcare regulations and may view such a platform with apprehension, fearing it could disrupt cross-border drug purchasing habits or lead to a migration of pharmaceutical executive decisions.

In Canada, for instance, consumers could see an uptick in interest towards bargaining for better drug pricing, which may strain the existing healthcare provisions. Meanwhile, the UK and Australia may leverage the announcement as an opportunity to reinforce their current pricing strategies to avert a similar push towards cash models or direct sales.

Projected Outcomes and Future Developments

Looking ahead, the TrumpRx initiative promises several critical developments that stakeholders should closely monitor:

- Legal Scrutiny: The possible push-back from Democratic lawmakers over perceived conflicts with federal law could stall or modify the program significantly. The legality of cash-pay platforms will likely become a contentious political issue.

- Impact on Drug Pricing Trends: As pharmaceutical companies utilize TrumpRx for direct sales, a potential “race to the bottom” could emerge among manufacturers seeking consumer loyalty through competitive cash pricing.

- Consumer Adoption Rates: How consumers respond to the initiative in terms of actual utilization will reveal much about their understanding of healthcare economics and, ultimately, inform future healthcare policy directions.

As TrumpRx.gov begins to carve its niche in the healthcare landscape, its capacity to genuinely ease the financial burdens of consumers—while navigating legal challenges and market dynamics—remains to be seen. It offers a glimpse into a future where cash payments may increasingly disrupt traditional insurance models, but whether this bold strategy translates into lasting benefits for American patients is still an open question.