Dow Surges Past 50,000 Points, Achieving Historic Milestone

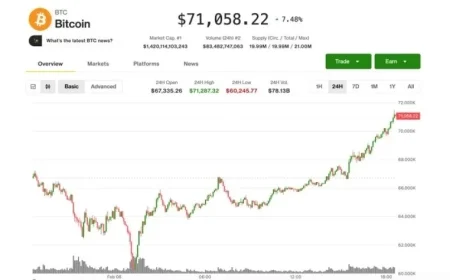

In a landmark moment for Wall Street, the Dow Jones Industrial Average surged past 50,000 points for the first time ever, closing at this pivotal milestone on a day that saw an impressive gain of 1,097 points, or 2.24%. This remarkable ascent is not just a numerical achievement but a powerful indicator of shifting market dynamics, reflective of broader economic realities amidst ongoing geopolitical turbulence. Such a milestone is a testament to the resilience of the US stock market and hints at deeper strategic currents influencing investor behavior.

Deciphering the Market’s Pulse: What Lies Beneath 50,000?

The Dow’s climb to 50,000 serves as a tactical hedge against the uncertainty clouding various global developments, including geopolitical tensions involving Iran and trade negotiations between the US and Europe. Investors appear to be adopting a dual strategy: they celebrate this historical milestone while simultaneously recalibrating their portfolios to account for risk factors, including persistent inflation and potential Federal Reserve missteps. Last Friday’s rally effectively reversed a three-day downturn in technology stocks, demonstrating a renewed confidence across sectors traditionally less exposed to volatility.

Sector Rotation Signals Shifts in Investment Sentiment

This remarkable rally shows a newfound breadth in market participation as investors increasingly diversify their attention beyond just technology stocks to include financials and industrials. Goldman Sachs and Caterpillar—the two most significant contributors to the Dow—saw respective gains of 4.2% and 6.4%, with Caterpillar reaching new heights. This shift may reflect broader market trends that suggest that a more extensive economic recovery could be underway, one that incorporates various industries rather than being tech-dominant.

| Before 50,000 | After 50,000 |

|---|---|

| Focus primarily on tech stocks | Increased investment across sectors (financials, industrials, healthcare) |

| Investor caution over geopolitical tensions | Renewed optimism despite risks, with targeted portfolio adjustments |

| Wall Street’s cautious sentiment | Wall Street’s enthusiasm balanced with vigilance over potential hazards |

| Dow lagging behind S&P 500 and Nasdaq | Dow leading the charge, with a diversification strategy in play |

The Broader Global Ripple Effect

The implications of the Dow exceeding 50,000 resonate beyond American borders. In markets like the UK, Canada, and Australia, investors are likely reassessing their strategies in light of US market movements. UK markets look to US trends for cues on investment timing, while Canadian and Australian economies, closely tied to US market performances, may also see sector-specific movements driven by shifts in investor confidence. The intertwining of global markets emphasizes the need for diversified portfolios that can withstand localized shocks.

Projected Outcomes: What to Watch in the Coming Weeks

- Expect Market Volatility: As tech companies report fourth-quarter earnings, there may be volatility that tests investor sentiment, suggesting strategic recalibrations may be necessary.

- Sector Performance Races: Investors will closely monitor which sectors continue to attract capital, especially given the positive outlook on industrials and financials due to rising interest rates.

- Geopolitical Hazards Ahead: Elevated concerns regarding international tensions may prompt swift market reactions, making it crucial for investors to stay informed.

In the wake of this historical triumph for the Dow, the path ahead remains a balancing act. The milestone of 50,000 is more than just a number; it encapsulates the blend of optimism and vigilance required to navigate a landscape marked by unprecedented potential and inherent risks.