Google DeepMind Spurs Significant AI Investment Surge

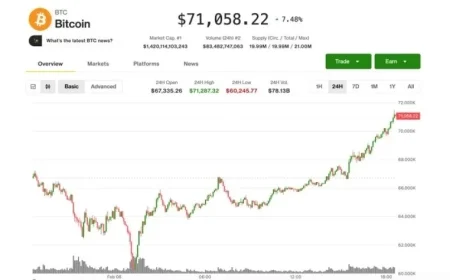

The recent earnings report from Alphabet Inc. has sparked significant investor reaction, particularly concerning the company’s plans for substantial capital expenditures related to artificial intelligence (AI). Despite posting earnings that exceeded expectations, Alphabet’s stock experienced a decline. This downturn reflects investor anxiety surrounding the company’s hefty investments in AI infrastructure.

Alphabet’s AI Investment Strategy

Analysts note that Alphabet plans to nearly double its capital expenditure towards AI compute capacity, which is set to increase from around $120 billion to $130 billion. The broader market reacted negatively to this announcement, as it raised concerns over near-term profitability and free cash flow implications. Investors are now focusing more on the capital spending implications than on the earnings report’s positive outcomes.

Market Dynamics and Broader Impacts

The tech sector has seen a general sell-off, particularly in software stocks, as fears grow about potential disruptions from AI tools. Investors worry that these advancements may challenge traditional software business models. Angelo Zino, a senior equity analyst at CFRA Research, emphasized this shift during a recent interview, noting that while Alphabet is investing heavily, the competitive landscape is becoming increasingly complex.

- Capital Investment: Nearly doubling expenditures for AI compute capacity.

- Market Reaction: Decline in stock prices despite earnings beat.

- Industry Concerns: Fear of AI disrupting traditional software markets.

Financial Insights

Alphabet’s growth in its cloud business has been notable, with a reported increase of 48%. This performance outstripped prior expectations and illustrates strong demand within the sector. Additionally, the company’s backlog has surged to approximately $240 billion. This figure reflects a 55% increase sequentially, showcasing substantial visibility in revenue over the next couple of years.

Future Outlook

Investors may witness immediate revenue growth from Alphabet’s investments in AI. However, free cash flow may not see similar increases in the short-term. As capital expenditures rise, the potential for a supply-demand imbalance also looms over the market. Analysts highlight the importance of maintaining a balance in spending and demand, as excessive expenditures could strain profitability across the industry.

- Revenue Growth: Expected increase from cloud and search due to AI investments.

- Cash Flow Pressure: Rising capex may hinder free cash flow in the near term.

- Supply-Demand Balance: A key risk for investors to monitor moving forward.

In conclusion, while Alphabet’s aggressive push into AI represents a strategic growth opportunity, it is not without its risks. The market’s apprehension surrounding capital expenditures reflects broader concerns about the tech industry’s future and profitability. Investors will need to closely monitor how these dynamics evolve in the months to come.