Strategy Stock Rebounds Strongly: Discover the Reasons Today

Recent market movements have showcased a strong rebound in Strategy stock and Bitcoin, reinforcing their interconnected nature. On Thursday, Strategy’s stock surged as Bitcoin prices recovered significantly, marking a day of optimism for investors in the cryptocurrency space.

Stock and Bitcoin Performance Overview

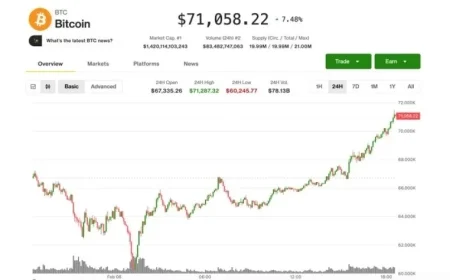

On Friday, Strategy (MSTR) experienced a remarkable increase of 22.8% by 2 p.m. ET. Concurrently, Bitcoin (BTC) saw gains of 10.3%. This upswing comes on the heels of a challenging previous day when both assets experienced sharp declines.

- Current Price of Strategy Stock: $134.90

- Day’s Change: 26.09%

- Market Cap: $31 billion

- Trading Volume: 2.9 million shares

Bitcoin’s Impact on Strategy Stock

The relationship between Bitcoin and Strategy is evident; when Bitcoin declines, Strategy often follows suit. This phenomenon is primarily due to Strategy’s significant holdings in Bitcoin, amounting to 713,502 Bitcoins, which are valued at approximately $49.9 billion currently. Despite this, Strategy’s market cap stands at $31 billion, leading to a notable discrepancy in valuation compared to its digital assets.

As a result of this unique positioning, any fluctuation in Bitcoin’s price is likely to lead to subsequent changes in Strategy’s stock value. For instance, Bitcoin witnessed a 50% drop from its peak last October, directly affecting Strategy’s performance.

Market Reactions and Future Outlook

The recent downturn in Bitcoin prices resulted from disappointing economic data, causing investors to review their positions in high-risk assets. Nevertheless, the market has since begun to recover, correcting what some analysts view as an overreaction to the initial negative news.

In addition to these market dynamics, Strategy recently released its fourth-quarter earnings report. While it did report revenue growth, the bottom-line losses overshadowed these gains. Executive Chairman Michael Saylor, during the earnings call, reinforced his long-term commitment to Bitcoin, expressing confidence in its value appreciation over time.

Saylor’s Long-Term Vision

Michael Saylor emphasized a philosophy of “indefinite Bitcoin horizon” during the recent earnings discussion. He stated that even in the event of significant price drops, Strategy’s debt obligations would remain secure.

This philosophy underlines the essential relationship between Bitcoin and Strategy stock, wherein positive developments for the cryptocurrency often reflect positively on Strategy as well.

Going forward, investors will be watching closely to see how Bitcoin’s market trends impact Strategy’s stock performance, particularly in a market that remains sensitive to economic signals.