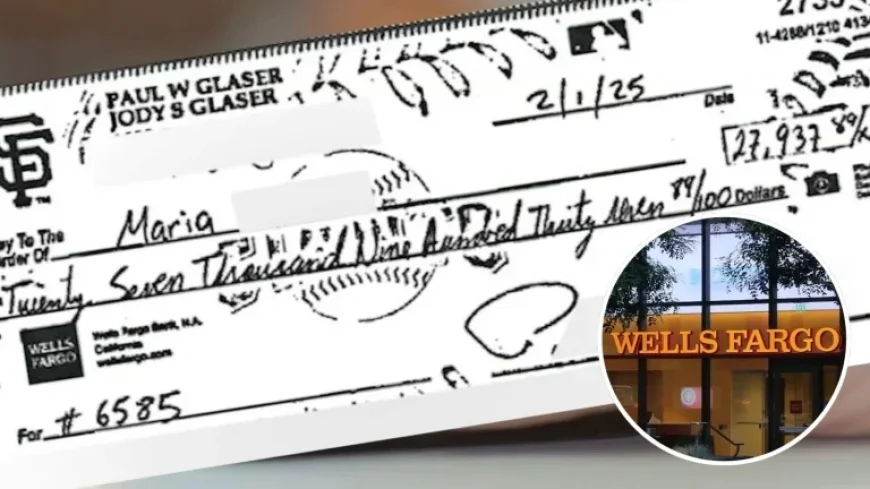

Wells Fargo Rejects $28,000 Refund to Santa Clara Homeowners After Mail Theft

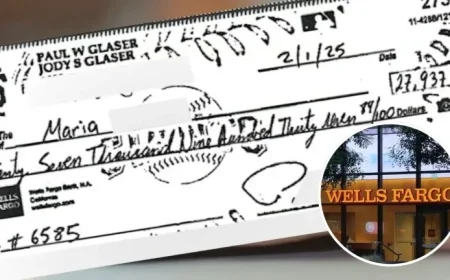

In a troubling incident in Santa Clara, California, two homeowners have faced significant financial losses due to mail theft. The homeowners, Kathy Pham and Jody Glaser, both experienced repercussions when their property tax payments were stolen from the mail and cashed illegally.

Rising Concerns Over Mail Theft

Mail theft is becoming increasingly common, with criminals specifically targeting checks. Many individuals still rely on traditional methods, like mailing checks, to pay their bills, unknowingly putting themselves at risk.

Incidents of Theft

- Kathy Pham mailed her property tax check for $2,400 only to find later that it had been altered and cashed by someone else.

- Jody and Paul Glaser discovered that nearly $28,000 was stolen from their account when they received a late notice regarding their property taxes.

Alteration of Checks

In both cases, the checks were altered. Criminals managed to erase the original payee’s name and replace it with their own. This manipulation allowed them to cash the checks as if they were legitimate payments.

Response from Wells Fargo

Both couples approached Wells Fargo for a refund, expecting assistance after the fraudulent transactions. However, their claims were denied due to alleged delays in reporting.

- Kathy Pham’s claim was rejected because she was told she waited too long to inform the bank.

- The Glasers received an automated denial for failing to notify within the prescribed 30-day window.

Bank Policies and Customer Responsibility

Wells Fargo cited its 42-page deposit agreement stating that customers are required to review monthly statements and report any unauthorized transactions promptly. However, the bank’s policies have caused frustration among customers.

Consumer Awareness and Prevention

Consumer advocate Teresa Murray emphasizes the necessity for individuals to understand bank policies and protect their financial information. Many consumers may not read the fine print when opening accounts.

Experts recommend several preventive measures against mail theft, including:

- Using electronic payment methods instead of checks.

- Monitoring bank statements regularly for any suspicious activities.

- Ensuring that checks are not dropped in unsecured mailboxes.

Conclusion

The incidents involving Kathy Pham and Jody Glaser highlight the critical issue of mail theft and its implications on financial security. As they navigate the aftermath of these events, both homeowners are left re-evaluating how they handle significant payments. For those in similar situations, staying informed and vigilant is key to preventing future losses.