How the US Can Gain from China’s Overcapacity

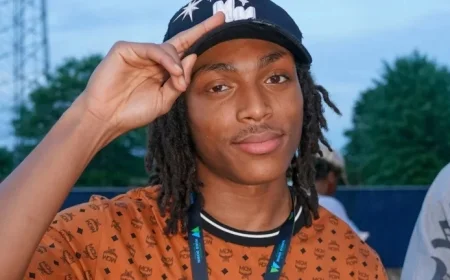

The narrative surrounding China’s industrial overcapacity reveals a complex web of strategic economic maneuvers that diverges sharply from Western interpretations. As Western media and policymakers point fingers at China’s “overcapacity,” they overlook a fundamental reality: China’s remarkable efficiency in producing solar panels, electric vehicles, batteries, and steel. Some industries indeed benefit from subsidies, but a larger factor is China’s swift accumulation of technical know-how and economies of scale. This ability to produce efficiently, rather than irresponsibly, unsettles competitors who find themselves ill-prepared to contend with a nation surpassing them in output and innovation.

Two Worlds of Economic Growth

The prevailing narrative portrays China as a producer of surplus goods, reminiscent of a Potemkin economy filled with ghost cities. However, this oversimplification bears scrutiny. Western commentators often lament what they perceive as waste or predatory dumping, leading to an eschatological prediction of inevitable collapse. Yet, as they deride China’s deflationary pressures, they simultaneously grapple with inflation in their own economies, exposing a deeper ideological rift.

This contradiction spotlights contrasting paradigms: the United States prioritizes inflation as a marker of prosperity—evident in soaring asset prices, rising home values, and inflated stock indices—while China seeks growth through tangible reductions in the prices of essential goods. In this global economic theater, one can argue that both nations wield divergent measuring sticks, not just regarding how to sustain growth, but profoundly on what constitutes growth itself.

Comparative Stakeholder Impact

| Stakeholder | Before Chinese Overcapacity | After Chinese Overcapacity |

|---|---|---|

| Chinese Manufacturers | Limited production capabilities, higher costs | Increased market share, lower production costs |

| Western Competitors | Market dominance with higher prices | Pressure to innovate and reduce prices |

| Global Consumers | Higher prices, fewer product options | Lower prices, increased availability of goods |

| Policymakers | Focus on domestic production incentives | Re-evaluation of trade policies and subsidies |

Localized Ripple Effects

This narrative’s repercussions are felt across Western markets — particularly in the U.S., U.K., Canada, and Australia. Policy adjustments are likely as these countries reckon with the implications of China’s abilities. In the U.S., job losses in traditional manufacturing have sparked debates about reshoring capabilities, pushing for new initiatives that protect local industries without stifling price competition. The U.K., with its reliance on imports, may have to grapple with inflationary pressures while managing investment flows. Similarly, Canada and Australia must navigate their proximity to U.S. markets while fostering trade relationships that leverage Chinese efficiencies for local benefits.

Projected Outcomes

As we look to the future, several potential developments warrant close attention:

- Shift in Trade Dynamics: Expect a restructuring of trade agreements as Western nations seek to balance competition with cooperation, potentially opening doors for negotiations on technology sharing.

- Rise in Domestic Innovation: To counteract Chinese efficiencies, Western companies may double down on innovation, investing heavily in R&D to develop unique competitive advantages.

- Policy Revisions: Anticipate aggressive policy shifts aimed at incentivizing domestic production, including subsidies for green technology, aimed at both curbing reliance on Chinese goods and pushing for sustainable advancements.

In closing, recognizing China’s overcapacity not merely as a threat, but as a challenge that beckons a reevaluation of Western economic paradigms, can lead to fruitful adaptations that benefit global economic health.