Nvidia Stock Nears Low, Poised for Potential Six-Month Doubling Again?

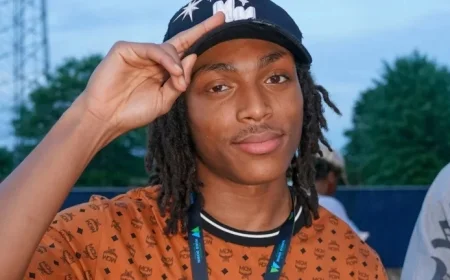

Nvidia’s stock is demonstrating a compelling narrative as its forward price-to-earnings (P/E) ratio approaches historical lows. Currently trading at 25 times forward earnings, this represents a unique opportunity for investors to capitalize on its undervaluation. Less than a year ago, Nvidia’s stock exhibited similar traits, yielding impressive returns that nearly doubled its value in a six-month period. This pattern suggests that Nvidia (NVDA +8.01%) could be on the verge of another substantial rally, particularly as the broader economic indicators remain solid—an essential backdrop to this absorbing saga.

Nvidia Stock: A Low P/E Amid Economic Resilience

The last time investors encountered a forward P/E ratio this attractive was in May 2025. Despite ongoing apprehensions stemming from political shifts, such as former President Donald Trump’s tariff actions, the U.S. economy has shown remarkable stability. While the stock market often reflects sentiment faster than the economy, Nvidia’s performance trajectory persists unchanged, retaining its allure among tech stocks.

The Economic Landscape and Nvidia’s Resilience

The chipmaker previously faced market turbulence in April 2025 following Trump’s tariff proposals, which initially sent tech stocks spiraling. However, even as those tariffs remained only partially retracted, the economy chugged forward. Nvidia’s stock, trading at approximately 24 times forward earnings during that low, rebounded significantly to over 40 times forward earnings, delivering an impressive 81% gain. This resilience illustrates the company’s robust fundamentals.

| Stakeholder | Before (April 2025) | After (November 2025) | Impact |

|---|---|---|---|

| Nvidia Investors | Stock at 24x P/E | Stock at 40x P/E | 81% gain offers validation for long-term strategic confidence. |

| AI Hyperscalers | Constrained by tariff uncertainty | Announcing record capex plans | Increased hardware demand propelling Nvidia’s growth. |

| Tech Sector Overall | Market downturn apprehensions | Recovery with renewed capital flow | Validates Nvidia’s market position; momentum benefits the entire sector. |

Nvidia’s Competitive Advantage in the AI Boom

Nvidia’s dominance in the AI accelerator market is further bolstered by the confirmed spending habits of hyperscalers, which are aggressively preparing for the future. With a forecast indicating global data center capital expenditures could soar to $3-$4 trillion annually by 2030, the chipmaker stands poised as a principal beneficiary of this burgeoning trend.

Wall Street anticipates a revenue increase of 52% for Nvidia’s fiscal 2027, a slight deceleration from 63% growth expected in fiscal 2026. Yet factors such as enhanced sales to China or the successful rollout of new technologies can outpace these projections—confirming Nvidia as a prime avenue for investment during the ongoing AI revolution.

The Ripple Effect Across Markets

This favorable position echoes across several markets, from the United States to the UK, Canada, and Australia. Investors in these regions are likely to feel the impact as Nvidia continues to strengthen its foothold in AI amid escalating global competition. The stock’s current pricing and performance could invigorate investor confidence universally, provoking discussions about tech valuation trends and market potential.

Projected Outcomes: What to Watch

- Monitor Nvidia’s quarterly earnings report, which will offer insights into revenue trajectories and cost structures relative to AI sales.

- Keep an eye on capital expenditure announcements from major hyperscalers; any increase will likely point towards sustained growth for Nvidia.

- Assess geopolitical developments, particularly U.S.-China trade relations, as these may influence Nvidia’s supply chains and market access.

In conclusion, Nvidia’s stock emerges as a compelling investment opportunity, not merely due to its low valuation but because of its strategic positioning in an expanding AI landscape. With the potential to double by 2027, investors should recognize the underlying fundamentals driving the company’s sustained growth trajectory and prepare to act before the landscape shifts again.