Investor Criticizes Warner for Rushed, Flawed Netflix Agreement

Activist investor Ancora Holdings has raised concerns about Warner Bros. Discovery’s (WBD) agreement with Netflix. The firm, which holds significant shares in WBD, threatened to oppose this deal and initiate a proxy fight if the board does not consider a rival offer from Paramount. Ancora argued that the board has neglected its fiduciary duties by hastily entering into a deal with Netflix rather than seeking a potentially better proposal from Paramount.

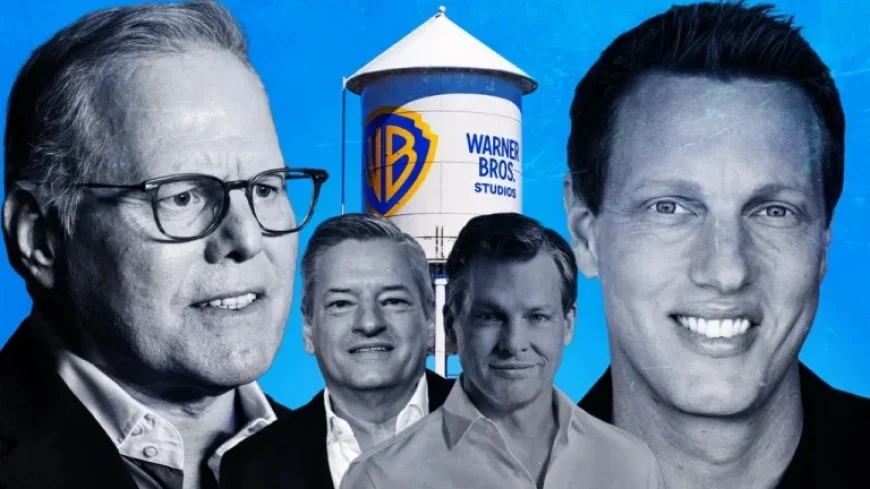

Rivalry Between Paramount and Netflix

On Tuesday, Paramount Skydance increased its hostile takeover bid for WBD. Ancora maintains that Paramount’s revised offer could yield superior value for shareholders compared to Netflix’s proposal, which they deem inferior. The activist investor highlighted the need for the WBD board to engage in negotiations with Paramount to maximize shareholder output.

- Ancora Holdings has a market interest of approximately $200 million in WBD.

- Paramount Skydance has revised its cash bid for WBD to $30 per share.

- Netflix’s offer stands at $27.75 per share.

Ancora’s presentation underscores that failing to explore Paramount’s proposal may lead to a backlash during the 2026 shareholder meetings. They indicated that they would vote against the Netflix deal, emphasizing the need for the WBD board to act in the interests of its shareholders.

Key Conditions of Paramount’s Offer

Paramount’s current offer includes a $0.25-per-share “ticking fee,” payable for each quarter that the deal remains unresolved past December 31, 2026. Additionally, Paramount has agreed to cover a $2.8 billion termination fee to Netflix if WBD decides to withdraw from the agreement.

- Paramount’s cash offer per share: $30

- Netflix’s cash offer per share: $27.75

- Proposed termination fee to Netflix: $2.8 billion

Regulatory Scrutiny and Market Reactions

As the bidding war intensifies, regulatory oversight has entered the conversation. The U.S. Justice Department is reportedly investigating potential anticompetitive practices related to Netflix’s acquisition of WBD. Recent statements from Netflix executives assert that their deal represents a net positive for the economy, compared to the anticipated cost reductions tied to Paramount’s bid.

Analysts have expressed varying opinions on the evolving situation. Seaport Research noted that Paramount’s enhanced proposal could lead WBD to reconsider its options seriously. On the other hand, Netflix has defended its deal in public forums, citing the stability and growth it aims to deliver to consumers.

Next Steps for WBD

The board of WBD faces crucial decisions in the days ahead. They must respond to Paramount’s improved offer, which has positioned itself as a serious alternative to the Netflix deal. Warner’s upcoming special shareholder meeting will likely focus on the competing proposals, with a date anticipated in April.

As negotiations and evaluations proceed, shareholders await WBD’s direction in the face of rising competition and scrutiny. The battle between Paramount and Netflix may prove pivotal for WBD’s future and its impact on the broader media landscape.