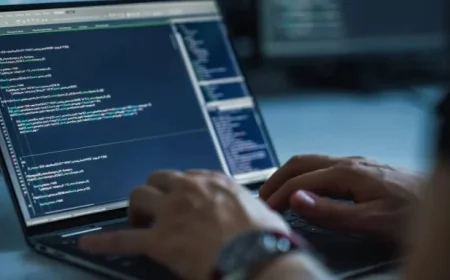

DraftKings Stock Falls on Weak Revenue Forecast (DKNG: NASDAQ)

DraftKings (DKNG) has experienced a notable slide in postmarket trading following the announcement of its mixed Q4 results and a full-year guidance that has left many investors feeling uneasy. Revenue surged by 43.2% year-over-year in Q4, reaching $1.99 billion, a figure that, while impressive, masks underlying challenges. This outcome can be credited to robust customer engagement and efficient new customer acquisition, coupled with enhanced sportsbook net revenue margins. However, the company’s dim future outlook has triggered speculations about its strategic positioning in an increasingly competitive landscape.

Understanding the Motivations Behind DraftKings’ Mixed Results

The mixed results unveil a tactical dilemma for DraftKings. On one hand, the company has successfully tapped into a burgeoning market fueled by increased interest in sports betting. Such engagement indicates a solid foundation for current operations. However, the decision to project a weaker-than-expected revenue forecast raises questions about its long-term strategy. This move serves as a tactical hedge against market volatility but also reveals a deeper tension between maintaining rapid growth and ensuring sustainable profitability.

Stakeholder Impact: A Closer Look

| Stakeholder | Before the Revenue Report | After the Revenue Report | Impact |

|---|---|---|---|

| Investors | Optimistic on growth | Concerns over forecasts | Increased volatility in stock valuations |

| Customers | High engagement and new offers | Uncertainty in future promotions | Potential decline in customer retention |

| Industry Competitors | Pressured by DraftKings’ growth | Opportunity to capitalize on DraftKings’ weaknesses | Heightened competition for market share |

Contextual Commentary: The Global Ripple Effect

The news of DraftKings’ stock declines resonates beyond the confines of U.S. markets. In the UK, where online gaming regulation is tightening, investors might view DraftKings’ weakened guidance as a reflection of broader regulatory challenges that could impact the sector. Similarly, in Canada and Australia, where sports betting is gaining traction, the apprehension surrounding DraftKings raises questions about the viability of aggressive expansion strategies in a swiftly evolving marketplace.

Projected Outcomes: What’s Next for DraftKings?

In the coming weeks, several developments are poised to shape the future for DraftKings:

- Price Adjustments: Analysts anticipate potential price corrections as investors recalibrate their expectations based on the company’s guidance.

- Competitive Dynamics: Competitors will likely attempt to leverage DraftKings’ uncertainties to capture market share, leading to aggressive marketing campaigns.

- Customer Loyalty Initiatives: To combat rising concerns about customer retention, DraftKings may unveil new promotions or loyalty programs aimed at maintaining user engagement.

As DraftKings navigates this critical period, it will be essential for stakeholders to closely monitor both its immediate responses and its strategic shifts to gauge the company’s resilience in a challenging economic landscape.