New Mortgage Crisis Quietly Strains Low-Income Homeowners – The Washington Post

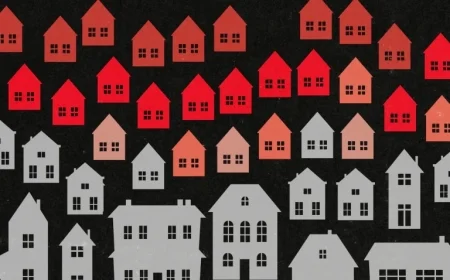

A new mortgage crisis is emerging, disproportionately affecting low-income homeowners. This crisis has significant implications for families struggling to maintain homeownership amidst rising costs.

Understanding the Crisis

Many households are facing increasing financial pressure as mortgage payments rise. This is particularly challenging for those with limited incomes. As these homeowners grapple with higher costs, some may find it difficult to meet their mortgage obligations.

Key Factors Contributing to the Crisis

- Rising Interest Rates: Increases in interest rates have led to higher monthly payments for many homeowners.

- Growing Household Debt: The burden of debt is becoming more significant, impacting financial stability.

- Job Market Fluctuations: Inconsistent employment opportunities make it difficult for low-income families to keep up with housing expenses.

Statistics and Trends

Recent reports indicate a troubling trend in delinquency rates. Homeowners are increasingly struggling to keep up with their mortgage payments. This trend raises concerns about the potential for widespread foreclosure.

Mortgage Delinquency Rates

According to data collected, mortgage delinquencies are on the rise, particularly in low-income areas. The impact is especially pronounced in regions with limited economic growth.

Impacts on Low-Income Homeowners

Low-income families face unique challenges during this crisis. Increased financial strain can lead to tough choices, such as prioritizing mortgage payments over other essential expenses.

Consequences of the Crisis

- Housing Instability: Families may face the risk of losing their homes, leading to homelessness.

- Community Disruption: An increase in foreclosures can destabilize entire neighborhoods.

- Long-Term Financial Damage: Missing mortgage payments can negatively impact credit scores, hindering future financial opportunities.

The new mortgage crisis serves as a reminder of the vulnerabilities faced by low-income homeowners. Addressing these challenges requires a concerted effort from policymakers, financial institutions, and community organizations.