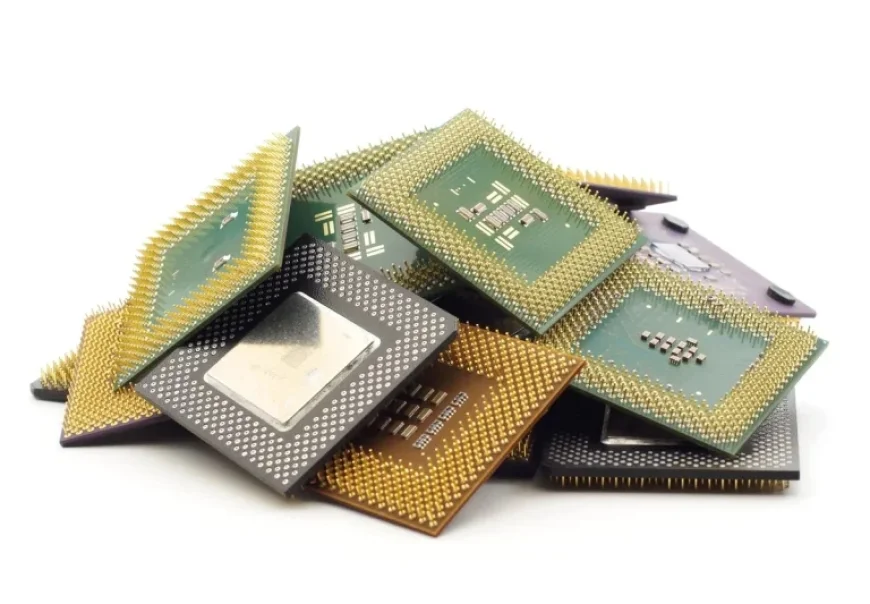

Micron Stock Set to Hit $1,200 by 2026’s End

Micron Technology is on a promising trajectory as it capitalizes on the growing demand for memory solutions, particularly in artificial intelligence (AI) applications. The company anticipates a significant increase in its stock price, potentially exceeding $1,200 by the end of fiscal year 2026.

AI Demand and Memory Shortage

The AI boom is expected to drive the need for memory hardware, specifically random access memory (RAM) and dynamic random access memory (DRAM). These components are essential for both computing devices and AI systems, which require memory to store and process their training data. Currently, the industry faces a shortage of these memory types, with Intel’s CEO predicting that relief will not come until 2028.

Micron’s Strategic Focus

Micron Technology has shifted its focus entirely towards meeting the needs of the AI market. In a bold move, the company exited the consumer PC memory sector in late 2025. In January 2026, Micron broke ground on a $100 billion semiconductor manufacturing facility in upstate New York. Once completed, this facility will be the largest of its kind in the United States.

Limited Competition in the Memory Sector

- Micron is one of only three major global memory manufacturers.

- It is the sole significant producer of RAM and DRAM in the United States.

- The other two major players are Samsung and SK Hynix from South Korea.

Given the premium on memory products and limited competition, Micron is poised for substantial growth.

Financial Performance and Projections

Micron’s financial figures from Q1 of fiscal 2026, reported on November 27, 2025, underscore its growth potential. The company recorded revenues of $13.6 billion, marking a 57% increase year-over-year. Notably, 79% of this revenue was driven by DRAM sales.

The gross margin for the quarter stood at 45.3%, complemented by an operating margin of 31.8% and a net margin of 28%. Furthermore, Micron exceeded earnings projections by 20%. The projected earnings per share (EPS) for Q2 is expected to reach $8.49, nearly double the Q1 EPS of $4.78.

Valuation Insights

Micron’s trailing twelve-month price-to-earnings (P/E) ratio is currently 39.31. While this appears high, it is lower compared to competitors like Nvidia, which has a P/E of 46.27. Based on consensus estimates for 2026 EPS, Micron’s share price could range from $1,190.30 to $1,424. This indicates a potential growth of 183% from its current trading price of approximately $420.

Conclusion: A Bright Future Ahead

With the right conditions, Micron Technology could surpass the $1,200 mark by the end of August 2026. As the company navigates through its ambitious plans and adapts to the robust AI memory demand, investors and analysts alike will watch closely for its performance in the coming years.