Spielberg, Zuckerberg Eye East Coast Amid California Wealth-Tax Concerns

Prominent figures in the entertainment and tech industries, Steven Spielberg and Mark Zuckerberg, are making headlines with their recent moves to the East Coast, prompting speculation regarding the influence of California’s proposed wealth tax. This 5% one-time tax on billionaires aims to generate funding for healthcare and educational services in the state, raising questions about the future of wealthy residents.

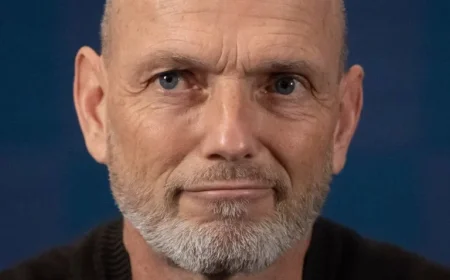

Steven Spielberg’s Move to New York

Renowned filmmaker Steven Spielberg has officially relocated to New York City. On January 1, he and his wife, actor Kate Capshaw, became residents of the prestigious San Remo co-op on Central Park West. This historic building has housed various celebrities, including Bono and Tiger Woods.

A spokesperson emphasized that Spielberg’s decision was motivated solely by a desire to be closer to family. The couple aims to spend more time with their children and grandchildren based in New York.

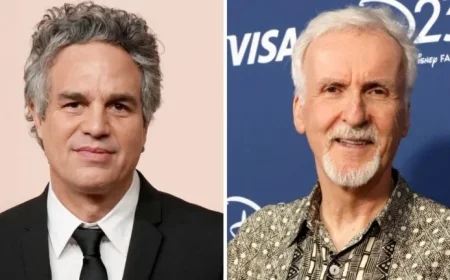

Mark Zuckerberg’s Florida Aspirations

Meanwhile, Facebook co-founder Mark Zuckerberg is considering purchasing a waterfront mansion in Indian Creek, Florida. Valued at around $200 million, this property sits in a wealthy enclave that includes notable figures such as Jeff Bezos and Ivanka Trump.

Representatives for Zuckerberg have not commented on his potential move. However, his interest has raised eyebrows against the backdrop of California’s proposed wealth tax.

Proposed California Wealth Tax

The proposed one-time wealth tax, targeting California billionaires, is gathering momentum. Spearheaded by the Service Employees International Union, advocates must collect nearly 875,000 signatures by June 24 to qualify for the November ballot. If approved, the tax is projected to raise approximately $100 billion to support healthcare services and education programs.

Critics warn this measure could drive wealthy residents, including Spielberg and Zuckerberg, out of the state. The increasing number of billionaires considering relocation reflects a deeper issue within California’s tax structure, which relies heavily on the income of its richest residents. The potential loss of these billionaires could impact state revenue significantly.

The Impact of Wealthy Residents’ Departures

California’s budget faces volatility due to its dependence on high earners for tax revenue. According to Governor Gavin Newsom’s budget summary, a small percentage of taxpayers contributes significantly to the state’s personal income tax revenue. This points to the risks of implementing a wealth tax amid concerns of an exodus of wealthy individuals.

Recent developments show a trend, as other high-profile individuals like David Sacks are also moving their operations out of California, signaling a shift that could affect the state’s financial landscape.

Conclusion

As Spielberg and Zuckerberg explore opportunities on the East Coast, their actions underscore the ongoing debate surrounding California’s wealth tax. The outcomes of both individual decisions and proposed measures will continue to shape the conversation about taxation and residency for the state’s billionaires. The landscape of wealth distribution and political influence in California remains an evolving issue.