SPY Stock and SPX Edge Higher as Investors Rotate Within Mega-Cap Tech; Oracle (ORCL) in Focus Amid AI Datacenter Spending

U.S. stocks leaned cautiously higher Monday, with SPY and the SPX grinding up as traders dissected sector rotations and an ever-louder drumbeat of AI-related capex. Oracle (ORCL) sat firmly on watch lists, its data-infrastructure narrative increasingly tied to hyperscale demand and the race to add reliable power near AI compute clusters. The market’s tone favored selectivity over chase—the kind of session where breadth and leadership matter more than the headline index print.

U.S. stocks leaned cautiously higher Monday, with SPY and the SPX grinding up as traders dissected sector rotations and an ever-louder drumbeat of AI-related capex. Oracle (ORCL) sat firmly on watch lists, its data-infrastructure narrative increasingly tied to hyperscale demand and the race to add reliable power near AI compute clusters. The market’s tone favored selectivity over chase—the kind of session where breadth and leadership matter more than the headline index print.

SPY Stock: Liquidity Beacon for a Rotation-Heavy Tape

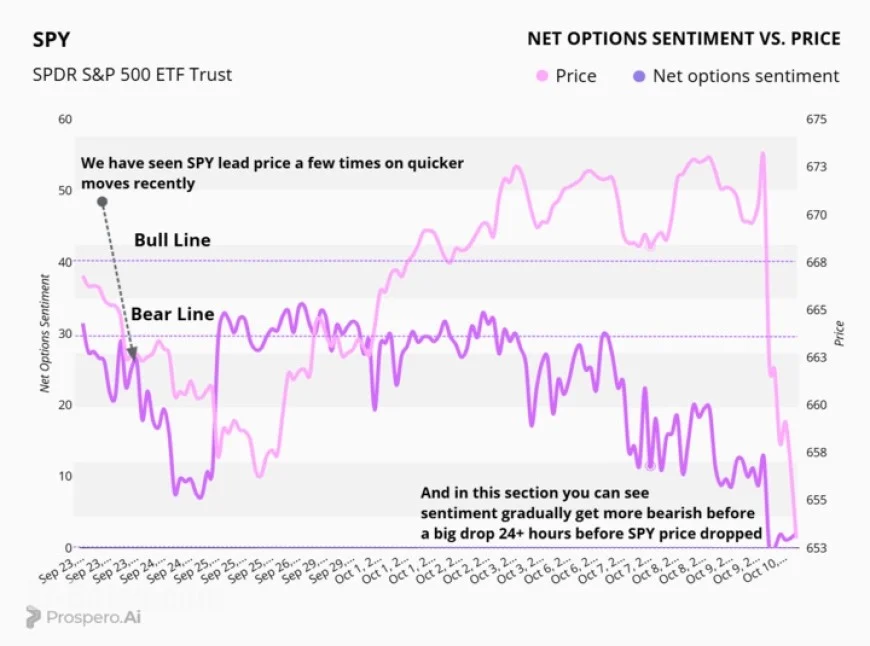

SPY, the S&P 500’s most traded ETF, reflected a market balancing two forces: resilient earnings from cash-rich leaders and a valuation ceiling that rises or falls with real yields. Intra-day, the ETF traded as a clean barometer for risk appetite, with flows clustering around opening range levels and afternoon tests of volume-weighted averages. The character of the move mattered more than the magnitude: dips were met with measured buying rather than panic bids, and strength required confirmation from semis, software, and key cyclicals.

What defined the session for SPY

-

Selective leadership: Mega-caps steadied the index, but secondary leadership rotated—energy, utilities, or industrials making cameo appearances contingent on yield drift.

-

Range discipline: Volatility compressed versus recent spikes; breakouts demanded breadth to stick.

-

Options gravity: Large same-day and near-dated positions pinned intraday inflections, reinforcing a “fade extremes, respect gamma” playbook.

SPX: Reading the Index Without ETF Noise

The SPX index itself showed a modest upward bias, supported by stable earnings revisions and improving forward revenue expectations in AI-exposed verticals. Yet beneath the surface, dispersion remained high. Stocks tied to infrastructure—power, cooling, networking—continued to command a premium, while rate-sensitive corners moved with every twitch in the front end of the curve. For portfolio managers, that translated into alpha via allocation rather than beta via blanket exposure.

Key SPX takeaways

-

Earnings quality over quantity: Markets rewarded clean beats paired with capex visibility and recurring revenue.

-

Margins under the microscope: Companies that can expand gross margins despite wage and power inflation kept advancing.

-

Defensives as ballast: Utilities and staples offered drawdown protection on weak breadth stretches.

Oracle Stock (ORCL): From Database Titan to AI Campus Enabler

Oracle remains a focal point for investors mapping the next leg of AI infrastructure. The story has evolved beyond core databases into cloud regions, sovereign builds, and tight integration with GPU supply and power availability. With grid bottlenecks slowing hyperscale timelines, Oracle’s appeal increasingly hinges on its ability to stand up capacity quickly—where to place compute, how to secure megawatts, and how to interleave cloud with enterprise AI workloads.

Why ORCL stays on the radar

-

Data gravity: Mission-critical datasets live close to compute; Oracle’s installed base is a springboard for AI services.

-

Partner flywheel: Ties with chip providers, colocation specialists, and on-site generation partners accelerate time-to-capacity.

-

Revenue mix shift: More cloud, more consumption pricing, and more multi-year visibility can smooth cyclicality.

Market Internals to Watch This Week

Traders tracking SPY, SPX, and ORCL should keep an eye on the following real-time gauges:

-

Breadth & new highs: A rising SPX with stagnant new-high lists signals fragility; confirmation requires expanding participation.

-

Rates vs. growth: A swift move in real yields can flip leadership in minutes—especially for software and semis.

-

Power & capex headlines: Any update on datacenter power availability, grid interconnects, or behind-the-meter solutions can swing AI infrastructure plays, including Oracle’s ecosystem.

-

Options positioning: Large gamma levels around index round numbers often corral price, affecting SPY’s intraday character.

Strategy Notes: How to Trade the Current Tape

-

Use SPY for signal, single names for expression. Let SPY/SPX define risk-on versus risk-off, then express views in leaders with catalysts.

-

Respect dispersion. Stock selection beats index hugging when sector leadership is rotating hour by hour.

-

Lean into confirmed themes. AI-linked power, networking, and data platforms continue to attract incremental capital—Oracle sits at the intersection of all three.

In short, the market’s message today is nuanced rather than euphoric. SPY and the SPX are grinding higher, but the path is being paved by companies that can deliver capacity—compute, power, and data—on tight timelines. Oracle remains central to that build-out narrative, keeping the stock squarely in the conversation whenever AI infrastructure comes up.