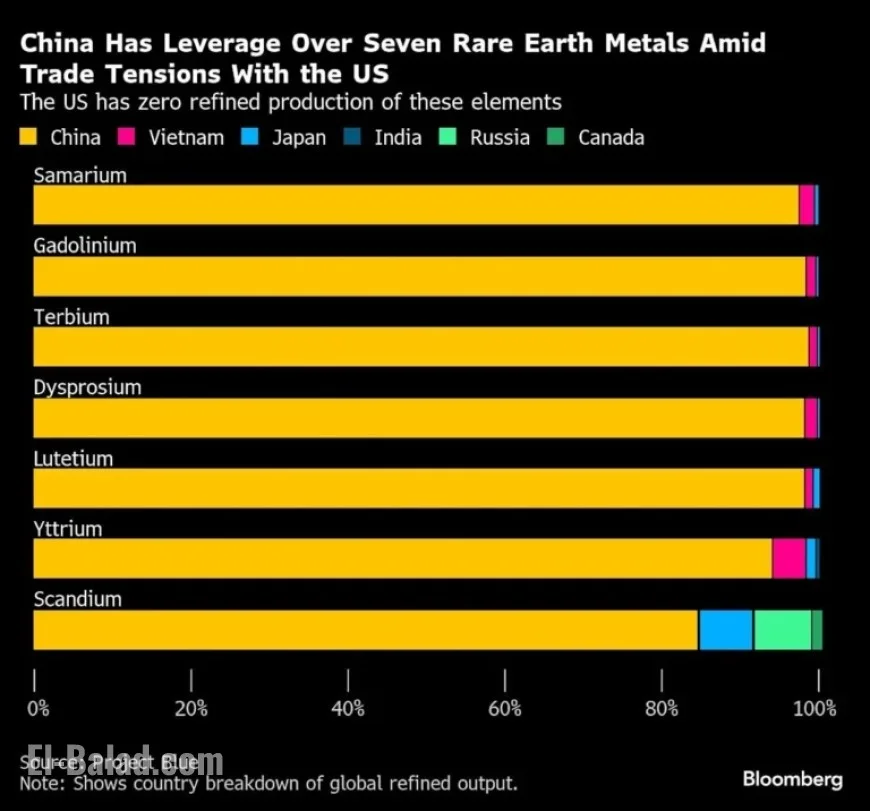

China Asserts Superpower Dominance with Rare Earths in Global Supply Chain

China has recently implemented significant restrictions on rare earth exports, asserting its dominance over this critical global supply chain. The new regulations require foreign companies to secure approval from the Chinese government before shipping products with even tiny amounts of select rare earth elements that are sourced from China. This move signals a shift in how China intends to control the flow of essential materials used in various industries, including aerospace and electric vehicles.

Details of China’s New Rare Earth Export Controls

- New regulations require foreign companies to obtain export approval from the Chinese government.

- Restrictions apply to products containing as little as 0.1% of certain rare earths sourced from China.

- The list of restricted materials now includes five rare earths: holmium, europium, ytterbium, thulium, and erbium.

Global Reactions and Implications

This action by China has provoked strong reactions from major economies, especially the United States and the European Union. U.S. Treasury Secretary Scott Bessent condemned the measures, indicating that they threaten supply chains worldwide. He anticipates coordinated responses from allies, including European and Indian partners.

The European Union’s Economy Commissioner, Valdis Dombrovskis, criticized China for using trade dependencies for political purposes and is expected to discuss necessary countermeasures during a meeting of the Group of Seven.

China’s Strategy and Global Market Impact

China currently accounts for approximately 70% of the world’s mined rare earths and over 90% of permanent magnets made from these minerals. The country’s recent moves mirror tactics historically employed by the United States, utilizing its dominance in key industries as leverage against foreign rivals.

Effects on Companies and Industries

The immediate economic ramifications of China’s restrictions have led to significant stock increases for Australian mining firms specializing in rare earths. For instance, Resolution Minerals Ltd. saw its shares rise by 56%, confirming a renewed interest in alternative supply chains.

In India, car manufacturers are exploring ferrite-based magnets as safer substitutes for heavier rare earths. Market stakeholders are actively assessing their reserves, signaling a shift toward securing more dependable sources of raw materials.

Future Outlook

As discussions surrounding these export controls unfold, China has signaled its intention to regulate the rare earths market more stringently. Officials argue that these measures are essential for national security, particularly due to the military applications of certain rare earths. However, the ambition to govern the global rare earth supply chain may lead to efforts by other countries to develop independent supply sources.

Analysts suggest that China’s assertive policies might backfire, potentially accelerating the search for alternatives among global manufacturers. The implementation of these rules is scheduled for December 1, leaving a critical window for other nations to respond and adapt to the shifting landscape of rare earth resources.

In conclusion, China’s proactive stance in regulating rare earth exports signifies a new chapter in global supply chain dynamics, prompting countries and companies alike to reconsider their dependencies.