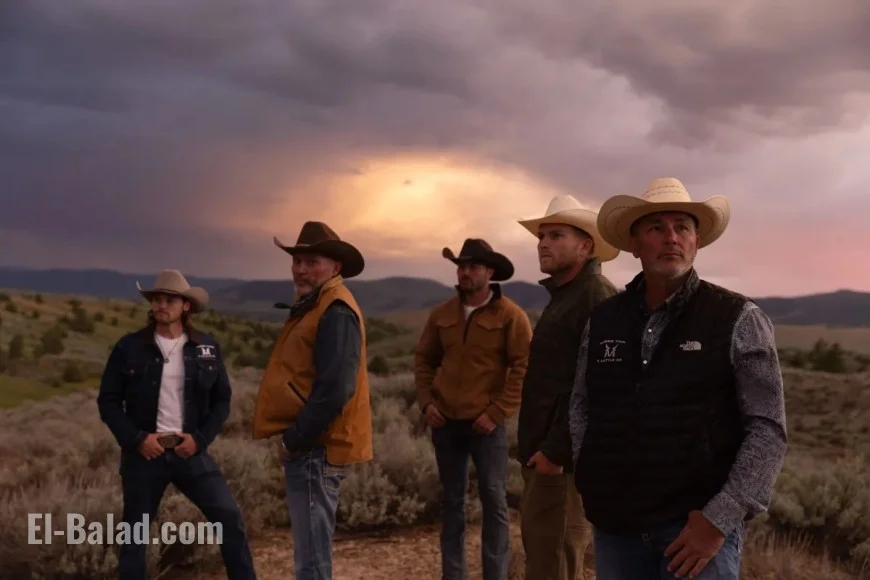

Steve McBee sentencing: 24 months in federal prison, $4 million restitution in crop-insurance fraud case

Reality-TV patriarch and Missouri farmer Steve A. McBee has been sentenced to 24 months in federal prison, ordered to pay $4,022,124 in restitution, and placed on two years of supervised release after pleading guilty to a federal crop-insurance fraud scheme. The sentence was handed down October 16, 2025 in federal court in Kansas City, with the judge directing McBee to self-surrender by December 1, 2025.

What the Steve McBee case was about

Prosecutors detailed a multi-year plan in which McBee underreported crop yields and filed false documentation tied to his farm’s corn and soybean production, inflating insurance payouts and subsidies. The conduct centered on the 2018 season, with related filings through 2018–2020, and led to more than $3.15 million in improper federal crop-insurance benefits and premium subsidies.

The government had urged a longer custodial term ahead of sentencing, citing financial harm to the U.S. Department of Agriculture’s risk program and the need for deterrence within the farming sector. The court ultimately imposed a two-year prison term, a restitution order slightly above $4 million, and post-release supervision.

Key facts at a glance

| Item | Detail |

|---|---|

| Charge | Federal crop-insurance fraud (single count via information) |

| Plea | Guilty (entered November 2024) |

| Sentencing date | October 16, 2025 |

| Prison term | 24 months (federal) |

| Supervised release | 2 years after imprisonment |

| Restitution | $4,022,124 to federal authorities |

| Surrender deadline | December 1, 2025 |

| Venue/Judge | U.S. District Court, Western District of Missouri; Judge Stephen R. Bough |

Note: In addition to restitution, McBee previously agreed to forfeiture tied to his gains from the scheme, a separate financial penalty that sits alongside the restitution order.

How the fraud worked—and why it matters

Crop insurance in the United States is a public-private program in which approved insurers sell policies that are federally reinsured. The integrity of the system relies on accurate reporting of acreage, planting dates, and yields. By understating production and misstating planting details, a producer can make a poor harvest appear worse on paper, triggering larger indemnity payments than warranted.

McBee’s case underscores the vulnerabilities of this framework: falsified production histories can reverberate for years because they also influence future guarantees and premium calculations. The court’s sentence—prison time, restitution, and supervision—signals a continued federal emphasis on deterrence in agricultural fraud.

Timeline of the Steve McBee sentencing

-

2018–2020: Conduct underlying the fraud, including underreported corn and soybean yields.

-

November 2024: McBee waives indictment and pleads guilty to one count of crop-insurance fraud.

-

October 16, 2025: Sentencing held in Kansas City; court imposes 24 months in prison, $4,022,124 restitution, 2 years supervised release.

-

By December 1, 2025: McBee is ordered to self-surrender to begin serving his sentence.

What comes next for McBee and his business

With a firm surrender date set, immediate priorities shift to custody preparation, restitution scheduling, and compliance with any asset-forfeiture terms already agreed with the government. On supervised release, McBee will be required to follow standard federal conditions, which typically include reporting to a probation officer, financial disclosures for restitution tracking, and limits on certain business activities tied to the offense conduct.

For the family farm operation, the near-term implications include potential leadership adjustments, scrutiny from private insurers and lenders, and the need to maintain strict documentation and compliance for future crop-insurance participation. While a single guilty count closes the criminal chapter, civil, contractual, or administrative follow-ons (such as program eligibility reviews) can continue separately.

Industry perspective: signals to other producers

-

Deterrence over leniency: Even first-time federal offenders in white-collar agriculture cases can face meaningful prison time when fraud touches public insurance backstops.

-

Documentation is destiny: Auditable, third-party records—scale tickets, elevator receipts, precision-ag logs—are increasingly decisive in both detecting and defending against fraud allegations.

-

Restitution can exceed initial payouts: Between restitution and forfeiture, the financial hit often outstrips the improper gains once interest, penalties, and compliance costs are added.

The Steve McBee sentencing caps a year-long legal arc from plea to punishment and delivers a clear message to the farm economy: misrepresenting production in a federally supported insurance program can lead to prison, millions in paybacks, and long-tail oversight after release. With a December 1 surrender deadline and a two-year term ahead, the case now moves from courtroom to correctional supervision—while the financial and operational consequences continue to ripple across the business he leaves behind.