Goldman Sachs: Gold Demand Driven by Fundamentals, Echoes Nixon Era

The price of gold has witnessed a substantial increase, driven primarily by fundamental factors rather than mere market speculation. Lina Thomas, a commodities strategist from Goldman Sachs Research, highlighted this trend in a recent video commentary.

Gold Prices Surge in 2025

In 2025, the price of gold soared 65%, reaching a record high of approximately $4,242 per ounce. This spike is largely attributed to economic uncertainties stemming from rising trade tensions between the United States and China. Additionally, tariff-related issues have contributed to the depreciation of the dollar, which historically served as a safe haven asset.

- Gold price increase in 2025: 65%

- Record price: $4,242 per ounce

- Projected price by end of 2026: $4,900

The Role of Central Banks

Central banks worldwide are also procuring more gold reserves to lessen their reliance on the dollar. This reflects a significant shift towards diversifying financial assets in response to global economic pressures. Notably, even leaders from financial institutions, such as JPMorgan Chase CEO Jamie Dimon, are recognizing the value of gold in current market conditions.

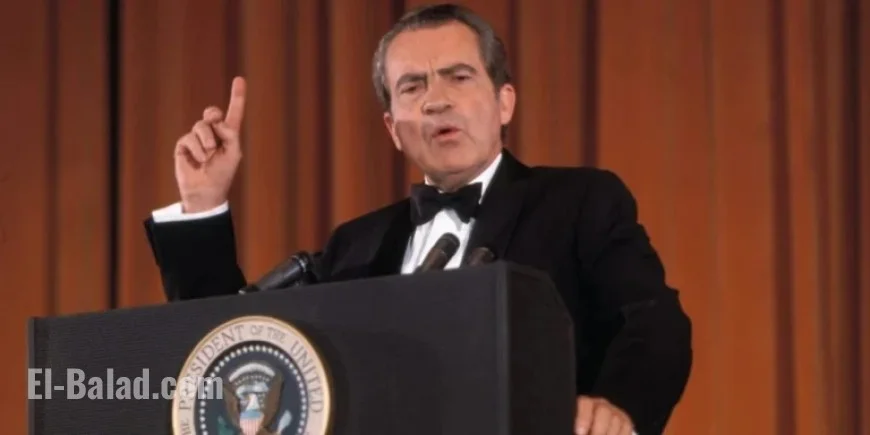

Historical Parallels with the 1970s

Thomas drew comparisons between today’s gold market and the notable gold rush of the 1970s. During that decade, under Presidents Richard Nixon and Jimmy Carter, gold prices escalated dramatically—from $35 in 1970 to $850 in 1980—an astonishing increase of over 2,300%. This surge followed Nixon’s decision to end the gold standard in 1971, coinciding with various economic challenges, including oil crises and rampant inflation.

“If those fears were to crop up again, we could see the global trend towards diversification intensify.” – Lina Thomas

Current Trends and Future Projections

Canadian businessman and gold investor Pierre Lassonde views the current market as a precursor to a bull market reminiscent of the 1970s. He likens the present time to the year 1976, predicting that the gold price will continue to rise significantly in the coming years. In 1975, gold began its rise from around $161, which lasted through the decade.

- Current year compared to the 1970s: 1976 in the current bull market cycle

- Price in 1975: $161

Experts suggest that investors should consider including gold in their portfolios as it serves as a hedge against economic volatility. The gold market’s relatively small size compared to equities means that price increases can occur rapidly, further attracting interest from investors.