Mayor Johnson’s 2026 Budget Faces Tensions Over $1B TIF Surplus

Mayor Brandon Johnson’s proposed 2026 budget is facing significant criticism. A central issue is the $1 billion tax increment financing (TIF) surplus. This surplus is intended to support the Chicago Public Schools (CPS), sparking a debate over its potential impact on local community projects.

Tensions Surrounding the TIF Surplus

During the initial City Council hearings, the proposed $1 billion TIF surplus raised concerns among council members. The budget allocates $552.4 million from this surplus to fund a new teachers’ contract. Critics argue that this move could hinder neighborhood improvements, which include schools, parks, and economic development initiatives.

Community Impact

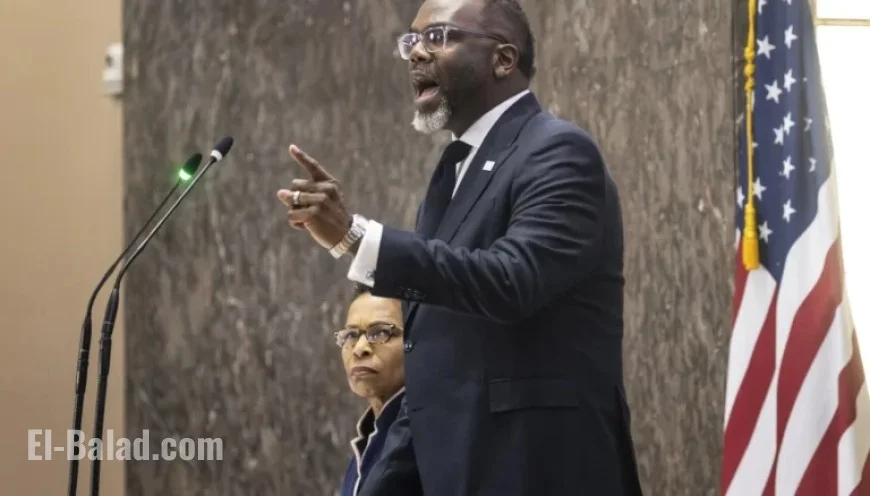

Alderman Michelle Harris, chair of the Rules Committee, voiced her opposition to sweeping the TIF funds. She pointed out that many predominantly Black neighborhoods rely on these funds to support local projects. “Without adequate TIF funds, our future projects are jeopardized,” she stated. Harris stressed the importance of keeping funding within communities that lack substantial financial resources.

Budget Director Annette Guzman defended the administration’s stance, saying that no projects were terminated to create the surplus. She explained that 83% of the city’s 108 TIFs are experiencing revenue growth. Guzman assured that there would still be funds available for future projects in these districts.

Concerns from Aldermen

- Alderman Nicole Lee (11th) expressed shock at the surplus size, highlighting that local aldermen were not consulted about the financial strategy.

- Alderman Jason Ervin (28th) pointed out that 70% of the surplus originates from economically disadvantaged areas, adding to the discontent.

Ervin raised an additional concern regarding a $175 million pension payment from CPS, which he insists must be addressed before moving forward with the budget. He stated, “This budget cannot progress without a signed agreement related to their pension obligations.”

Revenue Generation Strategies

The proposed budget aims to raise $433.2 million from a $21 corporate head tax per employee and a 14% tax on cloud computing services. However, these measures have faced significant criticism from business leaders, labeling them as detrimental to job creation.

As the council debates Mayor Johnson’s proposed budget, the future of neighborhood projects and educational funding hangs in the balance. Community leaders hope for more consideration of local needs in budgetary decisions.