Income Growth to Surpass Home Prices by 2026, Fueling Housing Reset

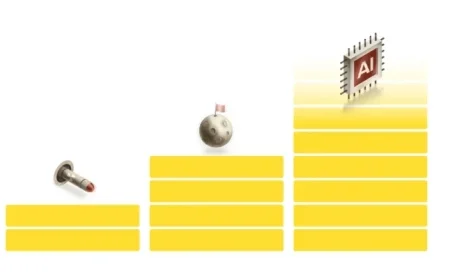

Homebuyers may encounter a significant shift in the housing market by 2026. Experts predict that income growth will exceed home prices, starting what is being termed the “Great Housing Reset.” This transition marks a notable change after a lengthy period post-Great Recession.

Housing Market Trends Ahead

According to a recent report by Redfin, several key predictions are shaping expectations for the near future:

- Mortgage Rates: Expected to decrease to the low-6% range, down from an average of 6.6% in 2025.

- Home Sales Prices: Anticipated to increase by only 1%, a drop from the previous year’s 2% growth.

- Monthly Housing Payments: Expected to grow at a slower pace than wage growth, projected at a steady 4%.

These trends are likely to enhance affordability, potentially re-attracting some house hunters back to the market. However, generational changes are also influencing living arrangements.

Shifts in Living Situations

Redfin’s report highlights a growing trend of alternative living arrangements among Gen Zers and young families. More adult children are expected to move back in with their parents. This illustrates an ongoing shift from traditional nuclear family structures. Homeowners in cities like Los Angeles and Nashville are adapting by remodeling homes to accommodate these new living dynamics.

As of 2024, homeownership rates among Gen Z were approximately 25%, while millennials reached about 54.9%. The housing landscape is likely to see more individuals living with family or roommates; data suggests that around 6% of Americans reverted to these arrangements due to affordability challenges.

Challenges to Home Affordability

Despite favorable income trends, challenges remain. C. Scott Schwefel, a real estate attorney, emphasizes that income growth and home price growth are vital, but do not offer a complete picture. Other financial factors, such as tax bills and mortgage rates, play a substantial role in determining actual affordability.

As public sentiment grows around the cost of housing, particularly among younger voters, there is increasing pressure for actionable solutions. However, high sale prices, fluctuating mortgage rates, and rising insurance premiums complicate this issue.

Outlook for First-Time Buyers

Despite positive indicators, the road to an affordable housing market for first-time buyers and young families may still be long. Industry experts, including Sergio Altomare of Hearthfire Holdings, describe the current market as “thawing” rather than surging. Prices are stabilizing, but significant relief is not yet on the horizon.

In summary, while income growth is set to surpass home prices by 2026, achieving true affordability will depend on various economic factors including taxes and living costs. The coming years may see extensive legislative efforts aimed at resolving the housing affordability crisis.