Trump pardon of Binance founder Changpeng Zhao jolts crypto—what it means for Binance and buying Bitcoin now

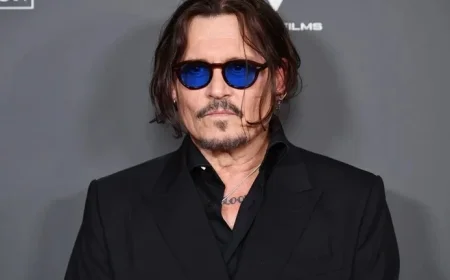

In recent days, President Trump issued a full pardon to Changpeng “CZ” Zhao, the founder of Binance, closing the book on a case that has loomed over the world’s largest crypto exchange since Zhao’s 2023 guilty plea. The clemency move instantly became the crypto story of the week, sparking sharp market moves, renewed regulatory debate, and a flood of questions from retail traders—especially those searching “buy Bitcoin Binance” in the wake of the news.

What the pardon changes—and what it doesn’t

The pardon erases federal criminal exposure for Zhao personally, restoring his eligibility to travel and engage in U.S.-facing business activities that were previously constrained. It also removes a lingering headline risk that has shadowed Binance’s brand since the case first broke, reducing the “key-person” overhang that can spook counterparties and users.

However, the pardon does not retroactively rewrite prior settlements, compliance commitments, or ongoing supervisory obligations affecting the exchange. Any civil, regulatory, or international matters tied to institutional conduct remain on their own tracks. Practically, that means day-to-day operations are still defined by licensing, banking access, and risk controls—areas where user experience tends to improve gradually, not overnight.

Market reaction: price pops, position shuffles, and sticky flows

Crypto markets treated the pardon as a risk-on signal. Native exchange tokens and assets linked—directly or indirectly—to Zhao’s brand outperformed, while Bitcoin traded firmly bid as liquidity chased the headline. Under the surface, on-chain and exchange dashboards showed a mixed flows picture: spikes in speculative activity alongside notable net outflows as some wallets de-risked into strength or rotated to self-custody. That split response is typical after binary news: momentum traders pile in, while longer-horizon holders use strength to rebalance.

For Binance, the immediate effect is narrative relief. The exchange benefits when counterparties view operational risk as falling; tighter spreads, improved order book depth, and steadier fiat rails tend to follow. Yet flows remain headline-sensitive—any follow-up enforcement chatter or governance misstep can quickly reverse confidence gains.

Regulatory and policy fallout to watch

A presidential pardon for a figure this prominent will reverberate through policy circles. Expect:

-

Clemency scrutiny: Lawmakers and watchdogs will probe whether the pardon’s timing or rationale intersects with ongoing digital-asset rulemaking.

-

Compliance audits: Exchanges seeking U.S. market growth will lean harder into KYC/AML controls, suspicious-activity reporting, and sanctions screening to demonstrate distance from the practices that drew heat in the prior cycle.

-

Global alignment: Non-U.S. regulators may reiterate that local licensing and conduct standards still govern market access, regardless of U.S. clemency decisions.

Net-net: the pardon lowers key-person legal risk but raises policy temperature, inviting more hearings and clarity pushes that could ultimately benefit well-regulated venues.

Buying Bitcoin on Binance: what users should know right now

The surge in “buy bitcoin binance” searches makes sense—news drives curiosity. A few practical notes for prospective buyers and lapsed users returning to the platform:

-

Account status & verification: Ensure your account is fully verified. Identity checks are standard and region-specific; incomplete KYC is the most common reason for failed deposits or purchase attempts.

-

Funding options: Availability of bank transfers, cards, and third-party payment rails varies by jurisdiction. Limits, processing times, and fees can differ between methods; confirm before initiating large transfers.

-

Custody choices: After purchase, consider whether to self-custody (hardware/software wallet) or keep assets on-platform for active trading. Each path carries distinct risks: platform counterparty risk vs. personal key-management risk.

-

Fees & slippage: Check maker/taker fees, spreads, and any conversion costs if your base currency differs from the quoted market. In volatile windows, use limit orders to control execution price.

-

Security hygiene: Enable 2FA, set withdrawal whitelists, and monitor login alerts. Review device permissions, API keys, and session history regularly.

-

Regional restrictions: Some features and tokens are geo-fenced. If a product tab is missing in your region, it’s typically a compliance setting, not an account error.

Bottom line: the platform remains operational, and the user journey to buy BTC is largely unchanged by the pardon—though confidence boosts can translate into tighter spreads and deeper books, improving execution quality for active traders.

For Binance as a business: credibility sprint ahead

With the legal cloud over its founder lifted, Binance has a window to cement institutional credibility. Priorities likely include:

-

Banking resilience: Deepening fiat on- and off-ramps to cut friction for retail and corporate clients.

-

Transparency beats: Regular proof-of-reserves/liabilities disclosures and third-party attestations to normalize risk communication.

-

Product governance: Cleaner token-listing processes and clearer conflict-of-interest policies to reassure wary institutions.

-

U.S. market posture: A careful recalibration that respects ongoing regulatory boundaries while exploring compliant growth lanes.

Key signals to track next

-

User asset balances: Sustained net inflows over the next 1–2 weeks would confirm confidence beyond the initial headline bounce.

-

Liquidity metrics: Improvements in top-of-book depth and lower effective spreads for BTC/USDT and BTC/USD pairs point to healthier market quality.

-

Policy calendar: Any congressional hearings, agency guidance updates, or court rulings that touch crypto market structure—especially custody, stablecoins, and exchange registration.

-

Leadership moves: Whether Zhao takes any formal or informal role going forward, and how governance structures evolve to align with compliance-first operations.

The takeaway: The Trump pardon removes a singular overhang from Binance’s story and gives CZ a clean slate. For users, buying Bitcoin on the platform looks much the same today as last week—but with sentiment tailwinds that can make trading feel smoother. The real test is what happens after the headlines fade: stronger controls, steadier banking, and measured growth will determine whether this moment is a turning point or simply a volatile detour.