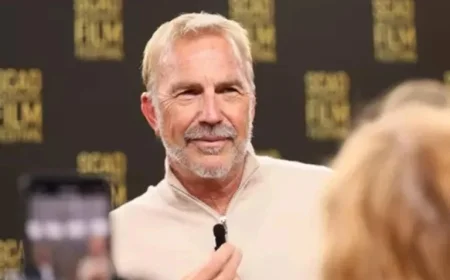

Judge Orders Chapter 7 Liquidation in Dr. Phil’s Merit Street Bankruptcy Case

A federal judge has ordered a Chapter 7 liquidation for Dr. Phil McGraw’s Merit Street Media, signaling a significant shift in the case surrounding the TV personality’s failed television network venture. This decision aims to serve the best interests of creditors, which include notable entities such as Trinity Broadcasting Network (TBN) and Professional Bull Riders (PBR).

Background of Merit Street Media

Merit Street Media was formed in collaboration between TBN, a not-for-profit Christian broadcaster, and McGraw’s Peteski Productions. The company filed for Chapter 11 bankruptcy protection on July 2, 2025, due to financial difficulties. Shortly thereafter, Merit Street initiated legal action against TBN for alleged breach of contract, claiming TBN abused its position as the controlling shareholder. TBN responded by countersuing McGraw for fraud.

Judge Scott W. Everett’s Ruling

During a recent hearing, Judge Scott W. Everett of the U.S. Bankruptcy Court for the Northern District of Texas ruled that a Chapter 7 liquidation would provide a fair solution for all creditors involved. Judge Everett stated that this process would ensure that a trustee handles the sale of assets impartially.

He emphasized that this approach is preferable to terminating the Chapter 11 case, which could allow McGraw to favor particular creditors over others, particularly TBN and PBR. Everett noted his experience with bankruptcy cases and remarked on the unusual nature of this case, stating, “I’ve never seen a case” where the debtor retained control in such a manner.

Implications of Chapter 7 Liquidation

A Chapter 7 bankruptcy entails the dissolution of a business, with its assets liquidated to pay creditors. Judge Everett expressed skepticism regarding the validity of Merit Street’s Chapter 11 efforts, characterizing the business as “dead as a doornail” since its filing. He indicated that the prior reorganization attempts lacked sincerity and proposed that moving to Chapter 7 would yield better outcomes for creditors.

Creditors’ Reactions and Ongoing Legal Issues

- TBN filed a motion for an emergency order to dismiss the Chapter 11 case or convert it to Chapter 7.

- PBR, holding a $181 million claim against Merit Street, supports TBN’s motion.

PBR accused Merit Street of breaching their agreement only five months after it was struck. They expressed relief that the court did not allow McGraw’s bankruptcy maneuvering. TBN alleges that McGraw orchestrated a scheme to benefit himself and his associates, while they seek financial reparations through a counterclaim.

Concerns Over Conduct and Future Steps

McGraw’s approach to the bankruptcy has raised concerns among creditors. Court findings revealed that McGraw deleted a key text message that diverged from the narrative he presented during the proceedings. A spokesperson for McGraw’s Peteski Productions disagreed with the ruling, emphasizing McGraw’s integrity and hinting at potential appeal strategies.

Next Steps for Merit Street Media

The shift toward a Chapter 7 liquidation represents a decisive moment in the ongoing saga of Merit Street Media. As the case unfolds, creditors hope that the appointed trustee will efficiently manage the sale of assets to satisfy outstanding claims. McGraw’s Peteski Productions intends to evaluate further options regarding their legal position.