Survey Reveals Majority of Gen Z Use Cash Only as Last Resort

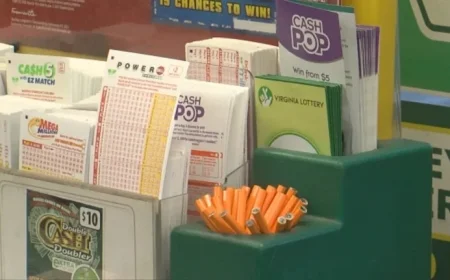

The shift towards cashless payments has gained significant traction in recent years, with traditional cash transactions falling behind credit and debit card usage. According to a recent survey by Cash App and Harris Poll, a significant number of Gen Z consumers consider cash payments as a last resort.

Survey Insights on Gen Z Cash Usage

The survey, conducted from September 25 to 29, included over 2,000 U.S. adults. It revealed that more than half of Gen Z respondents exclusively use cash when absolutely necessary. Additionally, nearly one-third expressed that individuals who prefer cash payments are “out of touch” or “cringe.”

Gen Z’s Shopping Preferences

Interestingly, many young adults refuse to shop at retailers that operate on a cash-only basis. Discussions within Gen Z forums highlight a growing aversion to cash transactions. One user remarked on their preference for Apple Pay over cash, stating they no longer carry physical wallets. The perception of cash as cumbersome is prevalent among younger consumers.

The Decreasing Role of Cash

- On average, U.S. consumers complete 48 transactions monthly.

- Only seven of those transactions involve cash, according to the Federal Reserve.

- Kathleen Young, a Federal Reserve executive, mentioned that cash use appears to have stabilized.

Despite its decline, cash still holds its ground due to its accessibility and familiarity.

Gen Z Spending Trends

With debit and credit cards dominating the payment landscape, Buy-Now, Pay-Later (BNPL) services are surging in popularity among Gen Z consumers. Options like Klarna and Affirm allow individuals to pay for purchases in manageable installments, appealing particularly to those with limited credit histories. This financing method provides flexibility in budgeting for larger expenses.

For instance, a young traveler shared how she financed a $4,000 vacation using Afterpay, highlighting its capacity to ease financial pressure while planning trips.

Risks Associated with BNPL Services

- 42% of Gen Z and Millennials utilize BNPL options.

- Only 21% of older generations engage with these services.

While BNPL options present benefits, they also pose risks. Experts caution that users may overextend themselves across multiple payment plans, leading to financial strain, similar to the pitfalls associated with credit card debt. Legal professionals warn of the potential consequences of unmanageable payments, stressing the importance of sound financial practices.

In conclusion, Gen Z’s preference for digital payments and BNPL services reveals a significant shift in spending habits. As cash becomes increasingly reserved for emergencies, the landscape of consumer transactions continues to evolve.