Top Analyst Warns of ‘Prisoner’s Dilemma’ as AI Shakes Stock Market

A prominent market analyst’s alert regarding a potential “prisoner’s dilemma” in the stock market, coupled with signs of an “AI wobble,” has gained attention. Tony Yoseloff, managing partner and chief investment officer at Davidson Kempner Capital Management, expressed these concerns during a discussion with Goldman Sachs’ Tony Pasquariello. This conversation, recorded on October 20, raised questions about the implications of circular financing among AI firms.

Key Insights from Yoseloff’s Analysis

- Yoseloff addressed the increasing interdependence of companies in the AI sector, warning about significant investment risks.

- He likened the current market conditions to historical bubbles, such as the “Nifty Fifty” in the 1970s and the dot-com boom.

- According to Yoseloff, the concentration of wealth in a few stocks constitutes a major risk factor.

Market Reactions Following Earnings Reports

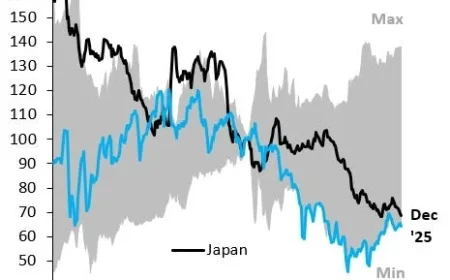

Despite Palantir’s bullish Q3 earnings, which included a revenue increase of 52% in U.S. government contracts, the stock market experienced a massive selloff. Palantir shares, which had risen 154% year-to-date, fell nearly 8% in one day following the earnings report. This sharp decline reflects investors’ worries about the sustainability of tech stock valuations.

Notable investor Michael Burry revealed a $1.1 billion short position against Nvidia and Palantir in early November, raising further alarm among investors. His actions coincided with a report indicating that the “Magnificent 7” tech stocks were responsible for over 80% of the S&P 500’s total returns recently, contributing to heightened market volatility.

CEO’s Response to Market Pressures

Palantir’s CEO, Alex Karp, reacted strongly to Burry’s short position during an appearance on CNBC. He defended his company by emphasizing its positive societal impact and solid financial performance. Despite his confidence, market trends signaled persistent concerns, with analysts questioning whether Palantir’s growth justifies its high valuation, as indicated by a price-to-earnings ratio exceeding 100x.

Future Market Predictions

Wall Street is bracing for potential corrections of up to 20%, as commented by executives from Goldman Sachs and Morgan Stanley. Yoseloff’s insights imply a critical juncture for the AI sector, where the fear of a “wobble” could lead to significant shifts in stock valuations. With an ongoing “prisoner’s dilemma,” valuable capital might be locked in underperforming investments, reminiscent of past financial crises.

For experienced investors, this period may present both challenges and opportunities. The volatility predicted by analysts could pave the way for new investment strategies as the market distinguishes between sustainable growth and inflated expectations.