Markets Suddenly Edge Towards Instability: Key Factors Explained

November has brought increased instability to the markets after months of consistent growth. Wall Street is experiencing notable shifts, particularly with the tech-heavy Nasdaq Composite, which has declined nearly 3.5% this month. This downturn marks its first losing month since March, resulting in a staggering loss of approximately $1.74 trillion in market value over two weeks.

Market Performance Overview

The session opened sharply lower on Friday, but swift buying allowed the Nasdaq to recover slightly, closing up by 0.13% after a drop of almost 1.9%. In contrast, the S&P 500 finished down by 0.05%, while the Dow Jones Industrial Average dropped by 310 points, or 0.65%.

- Nasdaq Composite: -3.5% for November

- S&P 500: -1.55% for November

- Dow Jones: -0.87% for November

- Market Value Loss: $1.74 trillion in the Nasdaq

- S&P 500 Value Loss: Over $1.3 trillion

Factors Contributing to Market Instability

Investors are navigating through heightened uncertainty, exacerbated by the recent government shutdown that delayed crucial economic data. This unavailability has left traders unsure about the Federal Reserve’s monetary policy moves.

Federal Reserve Speculations

Traders are now pricing in only a 46% chance of a rate cut in December, a sharp drop from 96% just a month earlier. Fed Chair Jerome Powell’s caution regarding rate cuts adds to the anxiety, especially as analysts express doubts about the central bank’s next steps due to inconsistent economic signals.

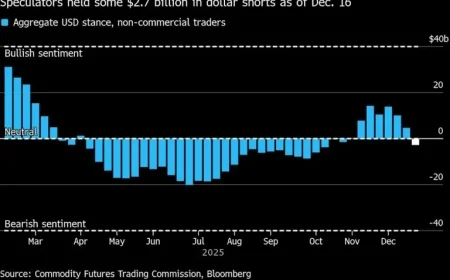

Investor Sentiment

Recent shifts in sentiment reflect a cautious outlook on tech stocks following a period of significant enthusiasm. High valuations in AI stocks have prompted investors to reassess their positions and take profits amid fears of potential downturns.

Cryptocurrency and Broader Market Sentiment

The cryptocurrency market mirrors this sentiment, with Bitcoin dropping 4% on Friday and down 25% since peaking in early October. The volatility suggests that risk-on investors are becoming increasingly cautious.

Conclusion

While some analysts view the current pullback as a healthy correction, the tech sector faces scrutiny regarding the profitability of large investments in AI initiatives. Companies like Oracle and Meta have experienced significant declines from their highs, indicating potential skepticism about their financial sustainability amid rising expenditures.

The next few weeks will be critical as investors digest incoming economic data and the Federal Reserve’s decisions, potentially reshaping the market landscape once again.