Effective Roadmaps Drive Profits and Fuel Sustainable Growth

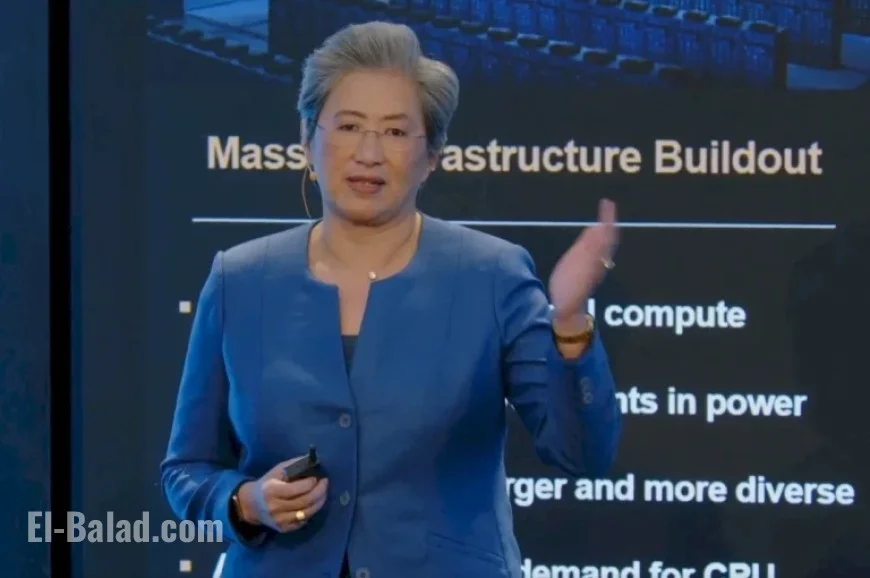

The recent Financial Analyst Day (FAD) held by AMD in New York emphasized the company’s renewed focus on the AI market and its competitive stance against rivals like Intel and Nvidia. CEO Lisa Su highlighted AMD’s strategic vision, especially regarding its datacenter operations and growth projections.

AMD’s Path to Growth

Over the past decade, AMD has shifted from being marginalized to becoming a key player in the technology sector. The company struggled with its reputation but has since regained trust with CIOs through strategic acquisitions. These include Xilinx, Pensando, and ZT Systems, which have expanded AMD’s portfolio to include CPUs, GPUs, and networking solutions.

Financial Analyst Day Insights

At the recent FAD, AMD’s leadership unveiled ambitious growth targets for the datacenter segment. Su stated that AMD’s datacenter AI revenue is expected to grow at a compound annual growth rate (CAGR) exceeding 80% over the next three to five years. Additionally, AMD anticipates capturing over 50% of the server CPU revenue share during this period.

- Projected server CPU revenue share: >50%

- Projected client CPU revenue share: >40%

- Projected FPGA revenue share: >70%

- Overall AMD revenue growth CAGR: >35%

- Expected revenues for 2025: $34 billion

- Estimated datacenter division revenue: $16 billion

Su emphasized that the datacenter market represents the largest growth opportunity for AMD. Key strategic pillars identified include leadership in compute technology and a committed approach to developing high-performance chips and systems.

Total Addressable Market Analysis

During her opening remarks, Su discussed AMD’s total addressable market (TAM) estimates. The initial TAM for AI was set at $300 billion, later revised to $500 billion based on strong customer demand and accelerated growth in AI technologies. AMD’s strategy incorporates a wide-ranging approach to silicon, software, and complete system solutions.

The expectation is that AI server CPUs will rise from approximately $8.2 billion in 2025 to nearly $30 billion by 2030. This surge is driven primarily by the burgeoning demand for AI capabilities and the need for powerful, specialized processors.

Upcoming Hardware Developments

AMD is preparing to launch new products, including the Venice Epyc processors based on the Zen 6 architecture, expected in 2026. These innovations will feature significant improvements in core density and performance. Furthermore, the MI400 series of GPUs is anticipated to enhance AMD’s offerings in AI datacenters significantly.

| Processor Model | Core Count | Release Year |

|---|---|---|

| Zen 6 Epyc | 172 (standard), 256 (half-cached) | 2026 |

| MI450 GPU | N/A | 2024 |

In summary, AMD’s roadmap highlights effective strategies aiming not only at profit but also at driving sustainable growth in the AI and datacenter markets. With its consistent focus on innovation, the company is positioning itself as a formidable competitor to legacy leaders like Intel and emerging players like Nvidia.