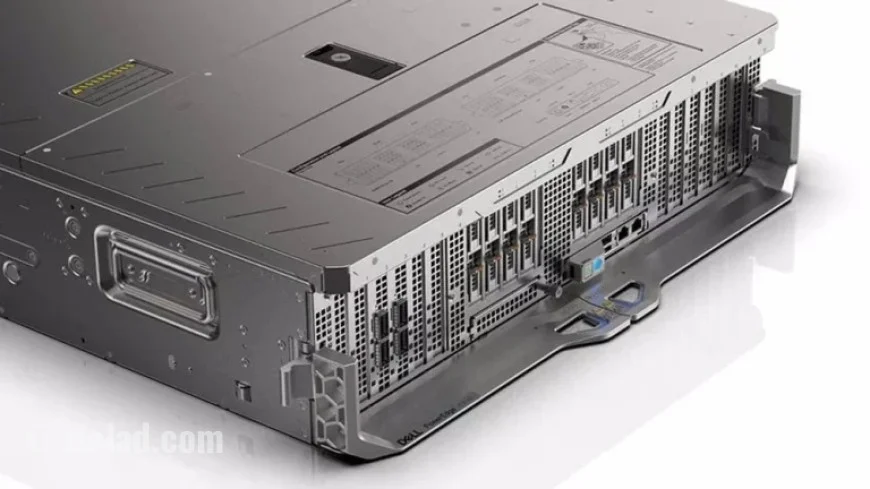

Dell and Others See Stock Decline Amid Margin Worries

Morgan Stanley has raised concerns about declining profit margins for computer manufacturers, driven by soaring memory-chip prices. Dell Technologies and several other tech stocks experienced a significant decline following this warning.

Impact of Rising Memory Prices on Tech Stocks

In a recent client note, Morgan Stanley analysts highlighted a “supercycle” in memory pricing, primarily affecting Nand and dynamic random-access memory (DRAM). This trend has been propelled by increasing demand from major data center operators and underinvestment in Nand technology.

Key Findings from Morgan Stanley

- Memory accounts for 10% to 70% of material costs in computer systems.

- Spot prices for Nand and DRAM have surged between 50% and 300% over the past six months.

- Contract prices for these memory types could rise by double digits each quarter through 2026.

- Memory fulfillment rates may drop to approximately 40% in the upcoming two quarters.

These developments indicate significant challenges for manufacturers as they strive to manage costs amid rising memory component prices.

Stock Downgrades and Market Reactions

In response to the anticipated financial impact, Morgan Stanley downgraded several tech stocks:

- Dell Technologies (DELL): Downgraded to underweight from overweight; price target cut from $144 to $110.

- Hewlett Packard Enterprise (HPE): Downgraded to equal weight; price target reduced from $28 to $25.

- HP Inc. (HPQ): Downgraded to underweight; price target lowered from $26 to $24.

- Other Companies: Taiwan and Hong Kong-traded Asustek, Giga-Byte Technology, Lenovo, and Pegatron also faced downgrades.

On the trading floor, Dell stock fell by 8.4%, closing at $122.48. HPE decreased by 7% to $21.23, while HP saw a decline of 6.8%, ending at $22.87. In contrast, memory-chip companies such as Micron Technology and Sandisk are experiencing record-high stock prices.

Ongoing Market Dynamics

Despite these challenges, factors like generative artificial intelligence and ongoing data center expansions are expected to drive demand in the tech sector. Analysts remain cautious yet optimistic about the long-term growth prospects associated with these trends.