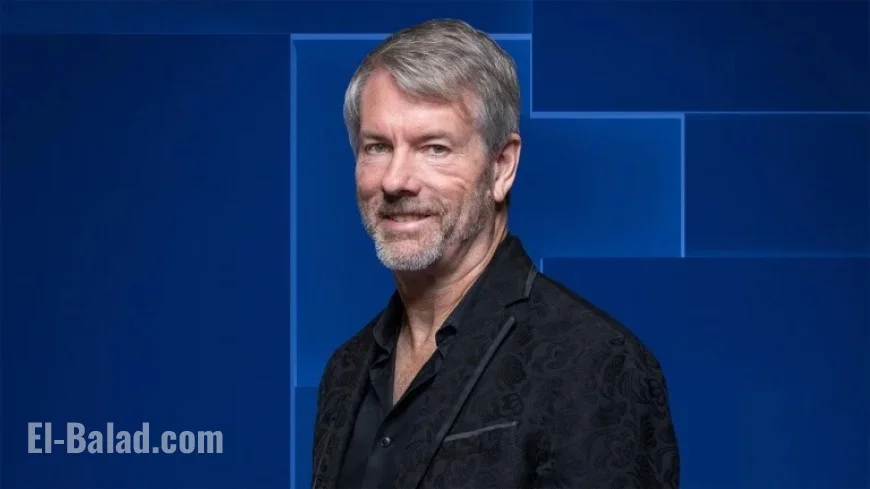

Does Bitcoin’s Plunge Jeopardize Michael Saylor’s Strategy?

Recent fluctuations in Bitcoin prices have raised concerns about the future of Michael Saylor’s corporate strategy at Strategy, his data mining software company. With Bitcoin’s value plummeting 35% over the last month—from $126,080 to $82,000—questions about the sustainability of Saylor’s approach are now front and center.

Impact of Bitcoin’s Decline on Strategy

For large companies, a decline in stock value often goes unnoticed. However, for Strategy, which holds a significant amount of Bitcoin, this drop prompts immediate scrutiny. Once trading significantly above its Bitcoin holdings, Strategy’s share price has now decreased by 60% in the past year. Currently, the company’s market capitalization stands at $49 billion, which is less than the $56 billion worth of Bitcoin it possesses.

- Bitcoin’s recent peak: $126,080

- Current price: $82,000

- Share price drop: 60% over the past year

- Market capitalization: $49 billion

- Bitcoin holdings value: $56 billion

Credit Rating and Market Risks

In response to these challenges, S&P Global Ratings recently assigned Strategy a B- credit rating, categorizing it as junk status. Analysts highlighted several concerns, including:

- High concentration in Bitcoin assets

- Narrow business focus

- Poor risk-adjusted capitalization

- Low liquidity in U.S. dollars

Additionally, analysts from JPMorgan have indicated that Strategy may be at risk of removal from major indices, such as MSCI USA and Nasdaq 100. This could lead to $2.8 billion exiting the stock, significantly impacting its liquidity.

Saylor’s Innovative Financial Strategies

Despite these hurdles, Saylor continues to innovate. He has pivoted his strategy away from solely tracking Bitcoin prices to creating bitcoin-powered income instruments. These new income-generating securities include perpetual preferred stocks that offer fixed dividends and are designed to attract more conservative investors.

- New securities issued: $8.6 billion

- Key issues and their yields:

- Strike (STRK): 8%

- Strife (STRF): 10%

- Stride (STRD): 10%

- Stretch (STRC): 9% (initial), adjusted monthly

These securities, particularly appealing to taxable investors due to their structure, are intended to reduce tax implications and increase yield. Nonetheless, the recent Bitcoin downturn has also affected these preferred stocks, leading to declines in their market value.

Future Considerations and Company Outlook

Strategy faces approximately $700 million in annual payments related to preferred dividends and interest on convertible debts. The company has issued around $8 billion in convertible debt, with significant amounts currently out of the money. This situation complicates further capital raising through equity, once a favored method for acquiring Bitcoin.

In light of these challenges, Saylor’s focus on innovative financing and income generation remains crucial. He has proposed utilizing Bitcoin derivatives and equity derivatives to enhance cash flow, while maintaining the option of strategic asset sales to address liquidity needs. The ongoing evolution of Strategy’s approach will determine its resilience in the volatile cryptocurrency market.

Conclusion

As Bitcoin experiences significant fluctuations, the implications for Michael Saylor’s strategy are profound. While the potential for income generation through innovative securities exists, the company’s heavy reliance on Bitcoin’s performance continues to pose significant risks. Investors will be closely monitoring how Strategy navigates these challenges in the coming months.