Gemini 3 Enhancements Propel Google Forward in AI Competition

The artificial intelligence sector is undergoing a notable transformation, primarily driven by Google’s advancements with Gemini 3. These innovations have triggered fluctuations in AI-related stocks, highlighting the competitive dynamics of the industry. Alphabet Inc. (NASDAQ: GOOGL), Google’s parent company, witnessed its stock surge more than 4% on Monday, building on an 8% increase from the previous week.

Gemini 3 Enhancements Drive Google’s Advancement in AI

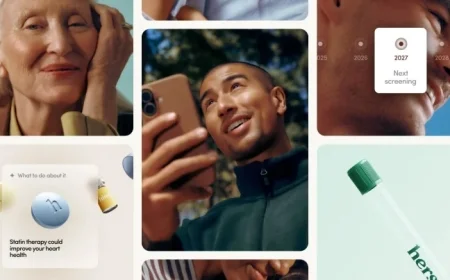

The introduction of Gemini 3 Pro, set for release on November 18, has startled analysts, thanks to its Deep Think reasoning mode. This feature has significantly outperformed initial expectations in various benchmarks—especially those set against Microsoft’s recent innovations at the Ignite conference and the launch of ChatGPT 5 in August.

Benchmark Performance and Availability

Gemini 3 has outshone competitors in areas such as coding, tool usage, mathematics, science, and multimodal reasoning. The model is now accessible through Google’s ecosystem and popular third-party platforms, including GitHub and Replit, which could bolster Google’s thriving API business.

Technological Advantages and Competitive Landscape

Google’s custom TPU chip—the seventh generation of its kind—offers a strategic edge in the market. According to analyst Ben Reitzes from Melius Research, the TPU enables Alphabet to maintain a pricing advantage. The TPU is currently viewed as a leading AI chip, alongside Nvidia’s GPUs, showcasing significant traction in the industry.

Implications for Competitors

This technological leap has raised concerns at OpenAI. CEO Sam Altman acknowledged in a recent memo that Google’s rapid advancements could present “temporary economic headwinds” for OpenAI. This situation, coupled with reports of slowing user growth, has shaken investor confidence, affecting stocks in various companies such as Oracle, AMD, Microsoft, CoreWeave, Broadcom, and Nvidia.

- AMD has experienced a 23% drop from its peak in October.

- Oracle’s stock has decreased by 39% since its high in September.

Both companies face exposure due to their ties with OpenAI. AMD is set to enhance its productivity with an additional 6GW capacity in the latter half of 2026, while Oracle lists a $300 billion engagement with OpenAI in its remaining performance obligations.

Investing in Stability Amid AI Market Volatility

For investors aiming for more stable options in this fluctuating AI landscape, Reitzes recommends looking toward Apple (NASDAQ: AAPL), IBM (NYSE: IBM), and Cisco (NASDAQ: CSCO). Apple is positioned as a key player in mobile AI, promising benefits regardless of the dominant player in the AI market. The analyst maintains a Buy rating for Apple with a target price of $345.

IBM remains a reliable option due to its focus on mainframe cycles and infrastructure software, while also exploring advancements in quantum computing. Meanwhile, Cisco is capitalizing on the demand for AI optics and thriving from a new wave of enterprise campus switching.