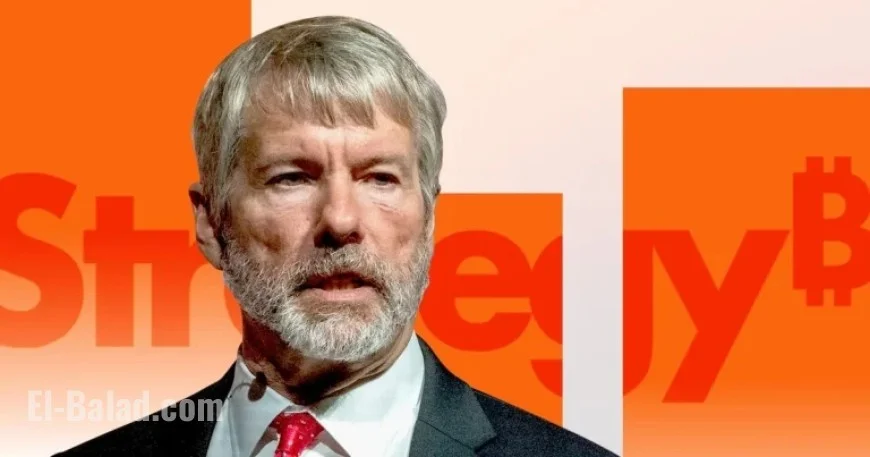

Michael Saylor’s Strategy Undervalued Compared to Bitcoin Holdings – DL News

Michael Saylor’s company, Strategy, has experienced a significant decline in its market-to-net-asset value (mNAV), which now sits at 0.879. This indicates that the company is valued less than the Bitcoin it holds, raising questions for investors. They are currently perceived to be paying approximately 80 cents for every dollar of Bitcoin owned by Strategy.

Understanding the Decline in mNAV

The latest figures from BitcoinTreasuries.net reveal Strategy’s mNAV has dipped below one for the first time since it began acquiring Bitcoin in August 2020. Analysts suggest that this decline stems from lower expectations regarding Bitcoin’s future performance rather than indicating any fundamental issues within Strategy’s business model.

Market Performance and Analyst Insights

André Dragosch, European head of research at Bitwise, suggests that the current market landscape reflects reduced optimism about Bitcoin’s prospects. He notes a strong correlation between mNAV and Bitcoin futures curves, indicating that as futures moderate, Strategy’s premium over Bitcoin diminishes.

- Dragosch stated, “The moment Bitcoin rises again, we should see an expansion of the mNAV as well.”

- Alexandre Schmidt from CoinShares agrees, noting that Strategy’s behavior aligns with its historical role as a leveraged Bitcoin play.

Impact of Summer Trends

Digital asset treasuries have faced challenges recently, with many trading below mNAV. The unsustainable premiums observed over the summer, where some companies traded at multiples of 3x to 7x mNAV, have now unwound as Bitcoin’s momentum has stalled. Schmidt remarked that these extreme trading levels made sense during Bitcoin’s previous rallies but have subsequently changed.

Investor Caution and Market Speculation

Renowned short seller Jim Chanos has expressed concerns about the sustainability of Bitcoin treasury companies, comparing the current scenario to the SPAC boom of 2021, which collapsed dramatically. His negative outlook on Strategy’s premium has been ongoing since May, leading him to argue that the financial underpinnings of the treasury model are flawed.

Current Financial Position of Strategy

As of now, Strategy holds approximately 649,870 Bitcoin, valued at about $56 billion, with an average purchase price of $74,430 per coin. Despite the recent decline in Bitcoin’s price, the company has appreciated its holdings by 16.3%. Nevertheless, its stock has seen a more significant drop than Bitcoin, reflecting broader market skepticism regarding its treasury model.

| Metric | Value |

|---|---|

| Market-to-Net-Asset Value (mNAV) | 0.879 |

| Bitcoin Holdings | 649,870 BTC |

| Average Cost per Bitcoin | $74,430 |

Both Dragosch and Schmidt believe that there is potential for mNAV recovery should Bitcoin experience a rally. However, projections suggest that the extreme mNAV levels seen during the summer may not return.