Elon Musk Predicts Future Value of Google and Nvidia Stocks

Tesla and SpaceX CEO Elon Musk has recently shared his insights on the future value of tech stocks, particularly those of Google and Nvidia. During an episode of the “People by WTF” podcast, hosted by Zerodha co-founder Nikhil Kamath, Musk revealed that he avoids traditional investing, focusing instead on building his own companies. Despite not actively investing in stocks, he believes that certain companies have the potential to lead the future economy.

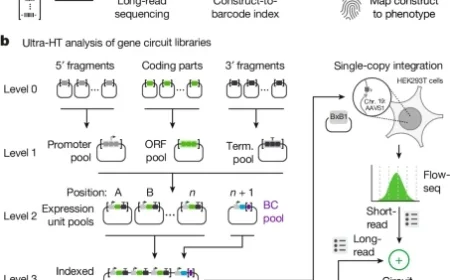

Elon Musk Discusses the Importance of AI and Robotics

Musk emphasized the significance of sectors such as artificial intelligence (AI), robotics, and space flight in driving economic value. He stated, “AI and robotics are gonna be very important,” highlighting their potential to create overwhelming economic output.

Future Tech Leaders: Google and Nvidia

Identifying key players in the tech landscape, Musk specifically pointed to Google (Alphabet Inc.) and Nvidia as frontrunners. He expressed confidence in Google’s capacity for value creation through its AI initiatives, stating, “I think Google is gonna be pretty valuable in the future.” Regarding Nvidia, Musk noted its obvious potential in the market.

Recent Performance of Google and Nvidia

- Nvidia’s Performance: In the third quarter, Nvidia reported revenue of $57.0 billion, marking a 62% increase compared to last year. This exceeded Wall Street’s expectations of $54.88 billion. The company has consistently outperformed, marking the 12th consecutive quarter of beating revenue and earnings forecasts, with earnings per share reaching $1.30.

- Alphabet’s Earnings: Alphabet’s Q3 revenue totaled $102.35 billion, surpassing analysts’ estimates of $99.64 billion. The company’s earnings per share were recorded at $2.87, beating the anticipated $2.33. This growth was driven by double-digit increases across all business segments.

Market Capitalization and Year-to-Date Performance

As of now, Nvidia boasts a market capitalization of $4.3 trillion, with shares having risen by 27.96% year-to-date. Alphabet follows closely, with a market cap of $3.8 trillion and Class A shares increasing by 69.02% this year.

Despite the fluctuating conditions in the market, both companies remain strong contenders for future economic dominance, largely due to their innovations in AI and technology.