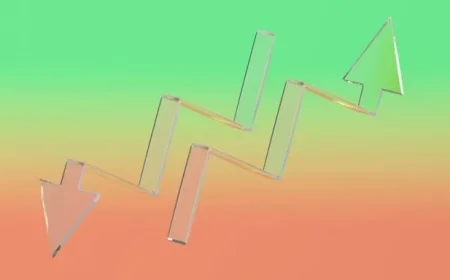

Mortgage Rates Drop, Reversing Last Week’s Increases

Mortgage rates have seen a shift this week, reversing last week’s increases. The bond market plays a significant role in determining these rates, often exhibiting volatility around holiday weeks.

Current Mortgage Rate Trends

As of the beginning of the week, the average top-tier 30-year fixed mortgage rate recently fell to 6.20%. However, a quick resurgence has brought this rate back up to 6.31%. This fluctuation demonstrates the erratic nature of the bond market, particularly during holiday periods.

Impact of Economic Data on Rates

Looking ahead, economic data is anticipated to have a more substantial influence on mortgage rates than recent unpredictable trends. Factors such as employment figures, inflation rates, and consumer spending can significantly affect bond yields, which, in turn, impact mortgage rates.

- Last week’s average mortgage rate: 6.20%

- This week’s average mortgage rate: 6.31%

- Fixed-rate mortgage type: 30 years

As market conditions evolve, potential homebuyers and those refinancing should stay informed about the latest economic news to better understand how it may influence mortgage rates in the short term.