This “Magnificent Seven” Company Emerges as a Leader in the AI Battle

The race for artificial intelligence supremacy has intensified among major tech companies. Alphabet Inc. is navigating this competitive landscape with renewed vigor after facing significant challenges. The year began with Alphabet embroiled in a lawsuit from the U.S. Department of Justice (DOJ), which posed a potential threat to its business operations.

Alphabet’s Resurgence in AI Leadership

As the year unfolded, Alphabet made strides, overcoming earlier challenges and increasing its stock value by nearly 68% as of November 26. Once considered a laggard in AI, the company is now seen as a frontrunner in the industry.

Legal Challenges and Market Impact

This year, Alphabet was confronted with accusations from the DOJ regarding monopolistic practices within its digital advertising and search sectors. With over half of its revenue stemming from Google Search, the implications of these allegations were profound.

A federal judge initially sided with the DOJ, pushing for a divestment of Google’s Chrome business. However, the judge ultimately refrained from mandating this action, citing competition from AI chatbots such as OpenAI’s ChatGPT. This ruling played a crucial role in alleviating concerns over Alphabet’s monopoly status.

Innovations Driving Growth

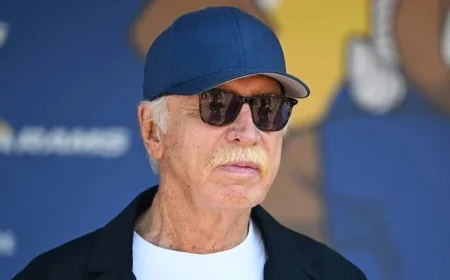

Alphabet has made significant advancements since these legal challenges. Its AI Overview feature, powered by the Gemini AI model, has significantly impressed investors by enhancing user engagement and query interaction. Bill Ackman’s Pershing Square Capital Management lauded this feature, noting its positive effects on user behavior.

Further solidifying its position, Alphabet launched AI Mode, an integrated feature designed to compete directly with conversational chatbots. The introduction of its new AI model, Gemini 3, promises improved responses to complex inquiries with less prompting from users. Analysts at HSBC predict that these innovations will maintain Google’s robust 90% market share in traditional search.

Emerging Technologies and Market Strategy

Recently, reports indicated that Google is exploring partnerships with hyperscalers such as Meta Platforms to provide specialized chips for data centers. This initiative has rattled the stocks of other significant chip manufacturers like Nvidia, as Google’s Tensor Processing Units (TPUs) target a niche more suitable for language models. Analysts speculate that Google’s TPUs could capture up to 10% of Nvidia’s market.

Future Prospects in the AI Landscape

Alphabet’s evolution illustrates the rapid transformations occurring within the AI sector. Initially, investor apprehensions surrounded Alphabet’s competitiveness. Now, the company appears ready to sustain its dominance, enhancing its search capabilities with AI integration. Additionally, Alphabet’s venture into chip production signifies its potential to reshape the AI landscape further.

In summary, Alphabet is positioned not just as a search engine leader but also a key player across various technology domains, including YouTube, Google Cloud, autonomous vehicles through Waymo, and quantum computing. For investors seeking AI exposure, Alphabet’s diverse business portfolio may present a more stable opportunity compared to investing solely in dedicated AI enterprises.