Home Prices Set to Decline in 2026: What Experts Predict

The housing market is facing a potential shift, with experts predicting a decline in home prices by 2026. As of 2025, market data indicates that there are significantly more sellers than buyers, raising questions about future price trends. While mortgage rates have experienced dramatic fluctuations, from below 3% in early 2022 to over 6% recently, housing prices have surprisingly continued their upward trajectory.

Current Housing Market Trends

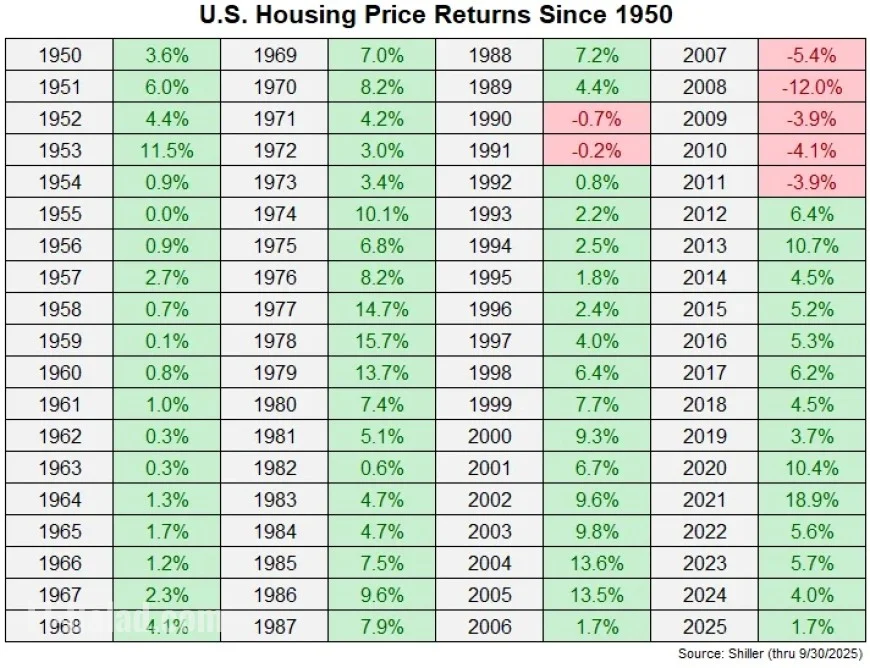

Data from Robert Shiller indicates that home prices increased by 6% in 2023, followed by 4% in 2024, and nearly 2% in early 2025. This trend defies expectations given the rising mortgage rates, which have dampened buyer enthusiasm. Recent statistics from Redfin suggest sellers outnumber buyers, which could signal a future adjustment in pricing.

- In 2025, nearly 60% of homes sold underwent at least one price reduction.

- New homes unsold have reached levels last seen during the summer of 2009.

Challenges for Homebuilders

Significant challenges face homebuilders across the United States. Despite efforts to attract buyers with reduced mortgage rates around 4%, many builders are struggling to sell newly constructed homes. As a result, the inventory of completed but unsold homes continues to rise, and so does the frequency of price cuts on homes that do sell.

Market Saturation and Regional Variations

Some regions are beginning to see notable corrections in home prices. For instance, cities like Austin, Cape Coral, and New Orleans are experiencing significant downturns:

- Austin: -26%

- New Orleans: -14%

These areas had previously experienced rapid increases in home prices, with values rising approximately 70% from 2020 through midsummer 2022. Now, as demand softens, these excessive gains are being gradually corrected.

Long-Term Outlook for Home Prices

Historically, home prices do not decline frequently. In 76 years, there have been only seven instances of nominal price declines, often linked to major financial crises. Even during recessions, the likelihood of sustained declines in home prices is low. Experts acknowledge the demographic trends supporting housing demand, as the largest age group in the U.S. is actively entering homebuying years.

While housing prices may stagnate to align more closely with income levels, a minor downturn could also be likely, especially if mortgage rates stay elevated. However, a dramatic market crash is still considered unlikely.

Potential Influencing Factors

If mortgage rates decrease, it may prompt buyers currently sidelined to re-enter the market. Yet, falling rates could also indicate a broader economic slowdown. This complex interplay of factors suggests that while a certain level of correction is possible in the coming years, the overall outlook for a housing crash remains subdued.

As the housing market evolves, continued monitoring of trends and rates will be crucial for potential buyers, sellers, and investors alike.