“OpenAI’s Stock Influence Wanes Amid Rising AI Risks”

Recent shifts in Wall Street sentiment underscore rising concerns about OpenAI’s future, specifically its profitability and sustainability as an industry leader. While OpenAI has seen its stock influence decline, Alphabet Inc. is gaining momentum as a formidable competitor in the artificial intelligence (AI) sector.

Stock Market Dynamics: OpenAI vs. Alphabet

Once considered the frontrunner in AI technology, OpenAI is now facing scrutiny over its financial viability. The company has substantial spending commitments, which raise questions about its ability to generate profits rapidly. In contrast, Alphabet, the parent company of Google, is emerging as a strong player with extensive resources across various aspects of AI.

Changing Investor Sentiments

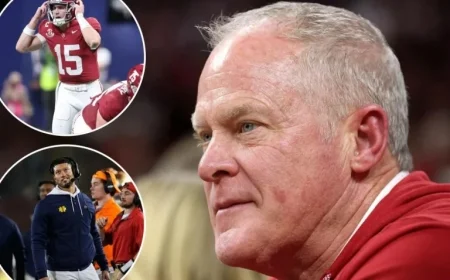

Brett Ewing, chief market strategist at First Franklin Financial Services, noted that the perception of OpenAI has shifted dramatically. Previously viewed as an innovative leader, it is now seen with caution. Ewing states, “Now sentiment is much more tempered toward OpenAI.”

This shift has led to significant selling pressure on OpenAI-related stocks, including:

- Oracle Corp.

- CoreWeave Inc.

- Advanced Micro Devices Inc. (AMD)

- Microsoft Corp.

- Nvidia Corp.

- SoftBank

Conversely, Alphabet’s success boosts its affiliated stocks, including:

- Broadcom Inc.

- Lumentum Holdings Inc.

- Celestica Inc.

- TTM Technologies Inc.

Market Performance Metrics

Companies connected to OpenAI have experienced a 74% increase in stock value during 2025. However, this pales in comparison to a remarkable 146% rise in the stocks connected to Alphabet. The Nasdaq 100 Index, reflecting broader tech trends, has risen 22% over the same timeframe.

The Competitive Landscape

OpenAI’s challenges intensified following its mixed reception of the GPT-5 unveiling in August. The favorable launch of Alphabet’s latest AI model, Gemini, further exacerbated these concerns. In response, OpenAI’s CEO Sam Altman has initiated a “code red” to enhance ChatGPT quality.

Brian Colello, a technology equity strategist, mentions that Alphabet possesses numerous advantages, including:

- The third highest market capitalization in the S&P 500

- Robust cash reserves

- Diverse business operations like Google Cloud and semiconductor manufacturing

- Strong subsidiaries including YouTube and Waymo

Financial Implications for Partners

The competitive gap between OpenAI and Alphabet may have profound financial repercussions for their respective partners. Should user interest shift toward Gemini, OpenAI may struggle to finance its cloud computing needs through partners like Oracle or AMD.

Meanwhile, Alphabet’s AI partners are thriving, as reflected in Lumentum’s stock price tripling and Celestica’s 252% increase in 2025. Broadcom’s stock has risen 68% during the same period.

Concerns Over OpenAI’s Future

OpenAI’s aggressive expansion strategy has drawn scrutiny over its financial stability. Analysts indicate that the gap between anticipated revenue and planned expenditures could reach approximately $207 billion by 2033. Despite expectations of generating over $12 billion in revenue by 2025, the company’s high operational costs add to investor anxiety.

While Oracle and AMD are not solely dependent on OpenAI for their success, the recent downturn in stock prices could represent a potential buying opportunity for discerning investors.

Kieran Osborne, CIO at Mission Wealth, emphasized the presence of untapped demand across industries. He believes that diligent efforts toward monetization will ultimately support long-term growth for companies in the AI space.