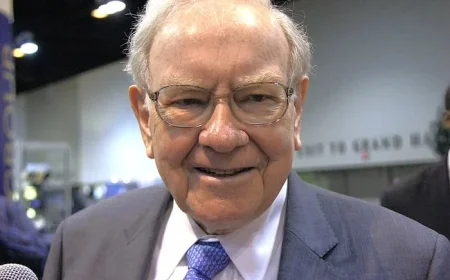

Warren Buffett Sells Recommended ETF: Investor Warning for 2026?

Berkshire Hathaway, led by Warren Buffett, recently divested its entire stake in two major S&P 500 ETFs: the Vanguard S&P 500 ETF (NYSEMKT: VOO) and the SPDR S&P 500 ETF Trust (NYSEMKT: SPY). This notable move has sparked discussions about its implications for average investors.

Buffett’s Investment Philosophy

Warren Buffett has long advocated for investing in an S&P 500 ETF as a simple and effective strategy. His philosophy centers on diversification, access to blue-chip stocks, and low fees. Despite Berkshire’s recent decision, Buffett’s foundational advice for everyday investors remains unchanged.

Reasons Behind the Sale

Berkshire Hathaway did not publicly disclose its reasoning for selling off its S&P 500 holdings. However, it is important to note that investment strategies can vary greatly among individuals and organizations. Each investor has unique goals, risk tolerance, and timeframes, making it unwise to mimic moves made by others blindly.

Understanding Market Movements

The sale is not necessarily a negative indicator for the S&P 500. It reflects Berkshire’s strategy tailored to its own financial circumstances. For the average investor, the S&P 500 remains a solid long-term investment option.

Investment Strategies for Individuals

Despite the current valuation concerns of the S&P 500, it may be an opportune time for dollar-cost averaging. This strategy involves:

- Investing a fixed amount regularly.

- Maintaining consistency regardless of market fluctuations.

- Mitigating the impact of volatility over time.

Benefits of the S&P 500 ETF

The Vanguard S&P 500 ETF (VOO) offers several advantages:

- Instant diversification across prominent firms.

- Low fees, with a 0.03% expense ratio.

- Strong historical performance, averaging 12.7% annual returns since its launch in 2010.

While past performance is not a guarantee of future results, VOO has shown significant potential for long-term growth.

Should You Invest in S&P 500 ETFs?

Before investing a significant amount in an ETF like VOO, it’s essential to evaluate all options. Analysts from El-Balad propose considering a range of stocks that may yield higher returns in the future. Their findings suggest that some stocks have historically outperformed leading ETFs.

Conclusion

In summary, while Warren Buffett’s recent actions have raised questions about the S&P 500 ETFs, his overall investment philosophy still favors this approach for most investors. By embracing consistent investing, like dollar-cost averaging, individuals can navigate market ups and downs effectively.