Netflix’s Top Wall Street Supporter Downgrades Over Warner Bros. Deal

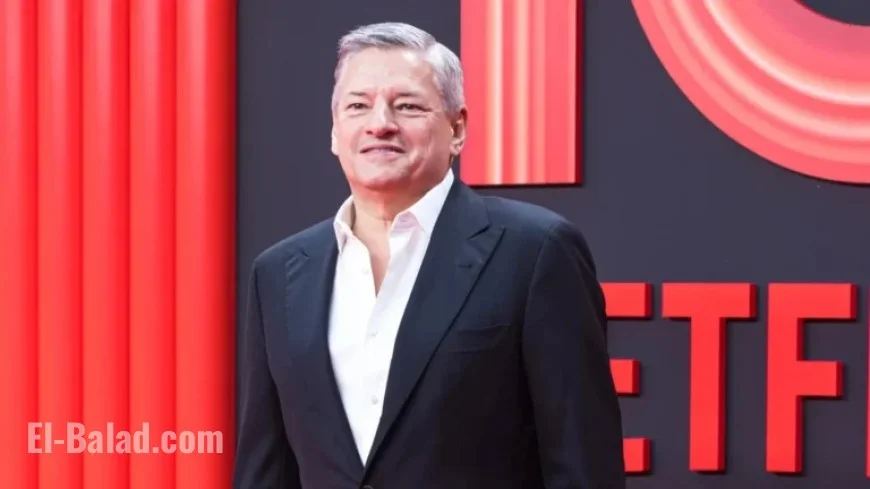

Netflix has significantly influenced the streaming landscape, and last week, it announced an $82.7 billion acquisition of Warner Bros. Discovery’s studios and streaming services. This hefty transaction has raised questions among analysts regarding Netflix’s strategic motives. Are the co-CEOs Ted Sarandos and Greg Peters, along with chairman Reed Hastings, seizing a rare opportunity, or are they responding defensively to competitive pressures?

Wall Street Reactions to the Warner Bros. Deal

Analysts are divided on the implications of this mega-deal. The acquisition could fortify Netflix’s position against competitors like Paramount Skydance and Comcast/NBCUniversal. However, concerns are surfacing about Netflix’s capacity to maintain audience engagement amid the surge of short-form video platforms such as TikTok and YouTube.

Analyst Downgrades Netflix Rating

Jeff Wlodarczak of Pivotal Research Group downgraded his recommendation on Netflix from “buy” to “hold.” He also adjusted his stock price target from $160 to $105. This shift reflects his apprehension regarding the motivations behind the Warner Bros. acquisition.

- The deal poses regulatory approval risks.

- There could be a bidding war with other studios, driving costs higher.

- This move signifies possible concerns about Netflix’s engagement levels.

Concerns About Long-Form Content

Wlodarczak emphasized that the acquisition reflects deeper worries about the long-term viability of traditional long-form content. As consumer attention continues to shift toward shorter social media formats, Netflix may be feeling pressure to adapt its strategy.

He pointed out that the lack of significant acquisitions in past years indicated confidence in Netflix’s organic growth. The recent deal, however, suggests urgency in countering challenges from rising short-form entertainment services.

The Future of Netflix’s Strategy

Wlodarczak outlined several key takeaways on the potential impact of the Warner Bros. deal:

- Declining engagement could foreshadow subscriber losses.

- Netflix’s hefty acquisition may be a stopgap to bolster content offerings amidst changing viewer habits.

- Long-term projections for subscribers and revenue may need reevaluation, as the Warner deal could complicate financial forecasts.

The streaming giant’s move holds the potential to reshape its competitive landscape. However, the coming months will reveal whether this strategy effectively counters the evolving consumer preferences in the entertainment sector.