Exploring Varied 2026 Economic Forecasts: Insights and Predictions

The U.S. economy’s outlook for 2026 is clouded with uncertainty, according to various economic experts. Predictions about growth show a cautious optimism, as many anticipate growth tempered by specific challenges.

Current Economic Landscape

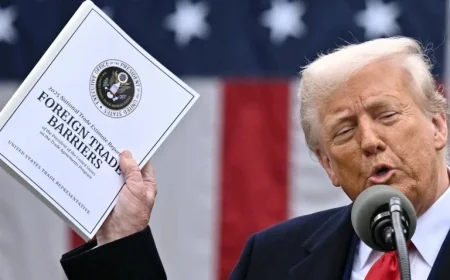

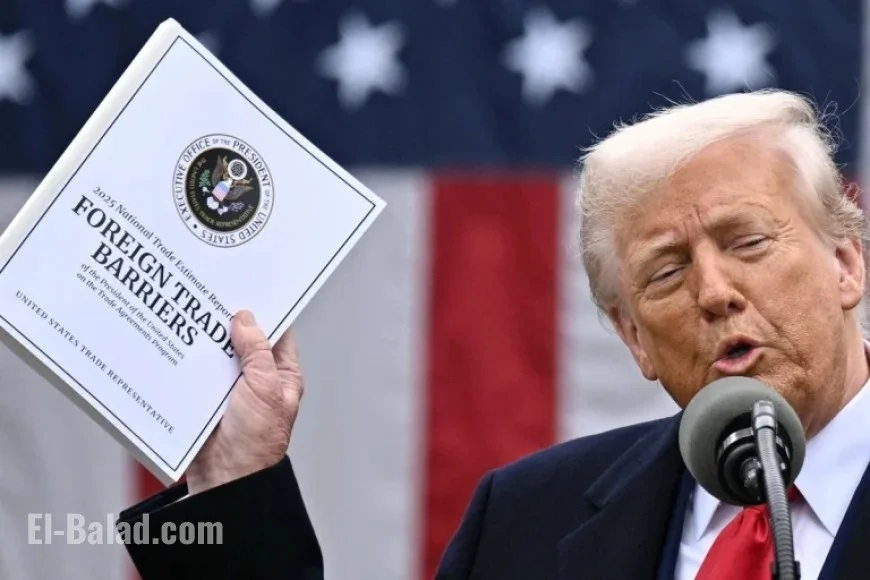

Throughout 2025, President Donald Trump’s trade policies led to significant fluctuations in the stock market. His administration’s focus on reducing immigration has also impacted the labor market, subsequently reducing revenue from Social Security. According to the nonpartisan group, The Tax Foundation, Trump’s tariffs are estimated to have increased U.S. household costs by roughly $1,100 in 2025.

Predictions for GDP Growth

Economic analysts have used various markers such as GDP trends and employment rates to develop their forecasts. The Organization for Economic Cooperation and Development (OECD) expects Real GDP to slow down by 1.7% in the upcoming year. This is attributed to lackluster employment growth, reduced immigration, and increasing tariffs on goods.

- OECD prediction: 1.7% GDP decline

- Royal Bank of Canada Wealth Management: 2.2% growth

- S&P Global Inc.: 2% growth with cautious consumer spending

- Morgan Stanley: potential GDP growth of 3.2%

Factors Impacting Consumer Spending

Consumer spending is a crucial indicator of economic health. Increased spending suggests greater consumer confidence and stimulates economic activity. Recent comments from JP Morgan Wealth Management suggest that the anticipated impacts of tariffs on consumer prices may be more manageable than previously feared. They predict inflation will stay contained, allowing for resilient consumer spending and corporate earnings.

Uncertainties on the Horizon

The Supreme Court is currently reviewing the legality of the President’s proposed tariffs on trade partners. The court’s decision could significantly influence economic forecasts for 2026.

The AI Investment Question

A growing concern amongst investors is the potential for an Artificial Intelligence (AI) bubble. Some experts worry that current investments in AI may be driven by speculative excitement rather than sustainable profitability.

JP Morgan’s outlook suggests no imminent AI bubble; however, they advise caution among investors. Contrastingly, Sam Altman of OpenAI has expressed concerns over excessive investor enthusiasm surrounding AI technologies.

- JP Morgan: No AI bubble but advises restraint in enthusiasm.

- Bank of America: Current tech boom is solid, with sustained AI investment growth.

- Sam Altman: Warns of possible investor overexcitement.

The conversations surrounding AI investment and consumer spending remain pivotal as we explore varied economic forecasts leading into 2026. How these dynamics unfold will be key in shaping financial policies and market performance.