Federal Reserve Set to Reveal Interest Rate Decision on Wednesday

The Federal Reserve is set to announce its interest rate decision on Wednesday, concluding a challenging year for the U.S. economy. The decision comes amid rising labor market challenges and inflation driven by tariffs, exacerbating the overall affordability crisis across the nation.

Interest Rate Decision Overview

Due to the ongoing government shutdown, the Fed will lack some significant economic data before the meeting. Key hiring statistics for November and recent inflation figures have been delayed, affecting the Federal Open Market Committee’s (FOMC) deliberations. The FOMC is tasked with maintaining stable inflation while keeping unemployment in check, a complex balance this year.

Current Economic Landscape

Many economists anticipate a quarter-point reduction in the federal funds rate during this meeting on December 10. According to CME FedWatch, there is an 88% probability that the Fed will lower the rate by 0.25 percentage points, bringing it to a range between 3.75% and 4%. This would mark the third consecutive cut by the central bank.

Implications of a Rate Cut

A potential rate cut could ease borrowing costs for consumers. Lower interest rates can reduce expenses from credit card debts and home equity loans. This change would likely benefit American households grappling with the climbing cost of essentials, such as food and healthcare.

- Current federal funds rate: 3.75% – 4%

- Expected rate cut: 0.25 percentage points

- Probability of rate cut: 88%

Federal Reserve’s Internal Dynamics

While many expect the Fed to proceed with the cut, not all members of the committee are aligned. Public comments from FOMC members, including John Williams, president of the Federal Reserve Bank of New York, indicate diverse viewpoints regarding the labor market and inflation concerns.

Future Rate Cuts in 2026

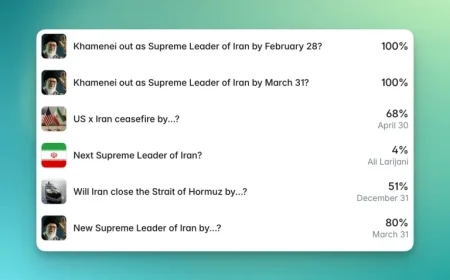

Looking beyond Wednesday, the question arises whether the Fed might signal additional rate cuts for 2026. Current forecasts suggest that rates may remain steady in the January meeting, with a 62% chance, according to a recent FactSet poll. However, the market anticipates potential cuts later in 2026, contingent on ongoing inflation above the Fed’s target of 2%.

Job cuts have been significant this year, with employers shedding over 1.1 million positions through November, the largest figure since 2020. The influence of artificial intelligence on job markets is also noteworthy, with many companies increasingly adopting AI, which could lead to further layoffs. This trend could influence the Fed’s monetary policy in 2026.

Conclusion

As the Federal Reserve prepares to announce its interest rate decision, stakeholders will be watching closely. The balance of inflation, unemployment, and changing economic factors will ultimately shape the Fed’s path forward.