Navigating a ‘Windchill’ Economy: Perception vs. Reality

Recent surveys indicate that the prevailing sentiment among Americans regarding the economy is overwhelmingly negative. Despite this widespread feeling, a closer look reveals that many individuals are experiencing financial improvements. Since June 2023, wage growth has consistently outpaced inflation on a monthly basis. However, perceptions of economic hardship persist, leading to what some are describing as a ‘windchill’ economy, where reality feels worse than it actually is.

The Disconnect Between Perception and Reality

Americans are feeling financial pressures, even as their earnings increase. The inflation crisis significantly impacted consumer psychology, creating a challenging financial landscape. While paycheck gains have been noted, inflation is once again rising, and individuals are confronted with sharp price increases on essential goods.

Key Financial Trends Since 2023

- Paychecks have been increasing faster than inflation since mid-2023.

- Inflation reached a peak of 9.1% in June 2022, while wages grew 4.8% during that time.

- As of September 2023, inflation stood at 3%, with wage growth at 3.8%.

Many Americans are still operating with tighter budgets due to rising costs in essential categories. Prices for food, electricity, child care, and rent have surged significantly, putting a strain on household finances. For instance, grocery prices have increased by 30%, and home prices have skyrocketed by 55% in recent years.

The Impact of Past Economic Conditions

The COVID-19 pandemic initially allowed many Americans to feel financially secure. With government stimulus and limited spending opportunities during lockdowns, savings increased and wages spiked. This created a short-lived perception of economic prosperity. However, as the landscape shifted toward inflation, this sense of security diminished.

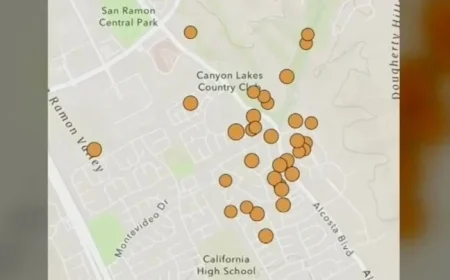

Housing affordability remains a concern, with the housing market becoming increasingly competitive. Starter homes are now priced well above previous averages, and high mortgage rates have complicated homeownership for many Americans.

Wage Growth Across Different Income Levels

Despite the overall rise in wages, the benefits have not been shared equally. Higher-income households saw their wages grow by 4% year-on-year as of November, which outpaced inflation. In contrast, lower-income households experienced negligible wage growth of just 1.4%. This discrepancy highlights the widening wealth gap in America.

Consumer Behavior and Spending Trends

The holiday shopping season has seen a shift in consumer behavior. While big-box retailers like Walmart and Costco are thriving by appealing to value-conscious shoppers, many middle and low-income households are scaling back on discretionary spending. Reports show that these groups are visiting stores less frequently and spending less overall.

This scenario reinforces the notion of a ‘cost-saving economy.’ As consumers adapt to rising costs, they are prioritizing essential purchases over luxury items.

Navigating Forward

The contrast between perceived and actual economic conditions calls for a deeper understanding of consumer sentiment. Policymakers and financial analysts must consider how rising costs on essential goods impact overall satisfaction. As the economic landscape continues to evolve, both for individuals and households, focusing on wage growth and inflation trends will be vital for navigating the complexities of the current economic environment.