SpaceX Plans 2026 IPO to Raise Over $30 Billion

SpaceX continues to move forward with its highly anticipated plans for an initial public offering (IPO), targeting to raise over $30 billion. This ambitious financial endeavor could position the company as the largest IPO in history, exceeding the previous record set by Saudi Aramco.

IPO Details and Company Valuation

Sources have indicated that SpaceX aims for a company valuation of approximately $1.5 trillion. This places it close to the valuation of Saudi Aramco’s all-time high of $1.7 trillion established during their 2019 listing.

The IPO is tentatively scheduled for mid-to-late 2026, although some reports suggest it could be postponed to 2027, depending on market conditions. So far, SpaceX has not publicly commented on these developments.

Market Impact and Financial Projections

- SpaceX’s IPO news has positively influenced the market, boosting shares of other space companies.

- EchoStar Corp saw a share price increase of up to 12%, hitting an intraday record.

- Rocket Lab Corp also experienced gains of approximately 4.3%.

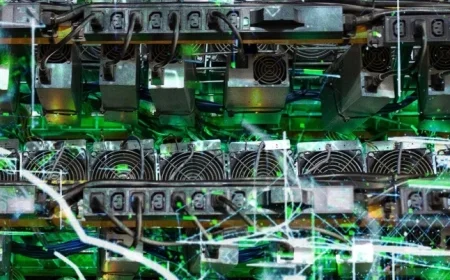

Financial analysis predicts SpaceX will generate around $15 billion in revenue by 2025, escalating to between $22 billion and $24 billion in 2026, largely driven by its Starlink satellite internet service. The anticipated IPO funds may help develop space-based data centers and purchase necessary technology.

Stock Offering and Current Valuation

In a recent secondary offering, SpaceX set a per-share price of about $420. This valuation surpasses earlier estimates of $800 billion. The company is allowing employees to sell stock worth approximately $2 billion while also planning to repurchase some shares to provide liquidity.

Starlink Future and Investment Background

SpaceX executives have entertained the prospect of spinning off Starlink into a distinct, publicly traded entity. However, CEO Elon Musk has expressed uncertainty about the timing of such a venture. Significant long-term investors include Peter Thiel’s Founders Fund, Valor Equity Partners, Fidelity, and Alphabet Inc.’s Google.

If SpaceX were to sell 5% of its shares at the proposed valuation, it could achieve an IPO totaling $40 billion. This would clearly surpass the $29 billion raised by Saudi Aramco in 2019, establishing SpaceX as a key player in financial markets.