Trump Media Merges with Fusion Energy Firm in $6 Billion Deal

The merger between Trump Media & Technology Group (TMTG) and TAE Technologies marks a significant shift in the energy sector. Valued at over $6 billion, this partnership aims to create one of the world’s first publicly traded fusion energy companies.

Overview of the Merger

TMTG, the company behind Truth Social, announced its collaboration with the Google-backed TAE Technologies. The deal, which is expected to close by mid-2026, is contingent on regulatory and shareholder approvals.

- Deal Value: Over $6 billion

- Ownership Distribution: Equal 50% stake for both companies

- Projected Completion: Mid-2026

Fusion Energy Revolution

This merger aims to pioneer utility-scale fusion power. Fusion power, a process that generates energy from nuclear fusion reactions, promises substantial energy output with minimal radioactivity. TMTG and TAE plan to start construction on their first plant next year.

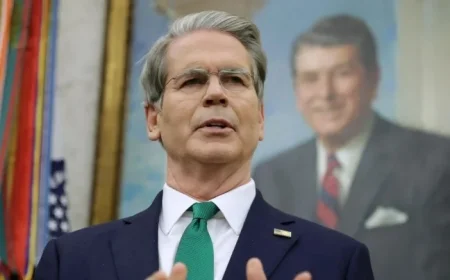

Leadership Structure

The combined entity will feature a nine-member board. Devin Nunes, the current CEO of TMTG, will serve as co-CEO alongside other executives, including Donald Trump Jr.

Financial Commitments

As part of the merger, Trump Media will provide $200 million in cash to TAE Technologies upon deal completion, with an additional $100 million following registration. This financial support reflects Trump Media’s commitment to advancing fusion technology.

The Growing Demand for Energy

The increasing electricity demand, particularly from AI data centers, has renewed interest in cleaner energy solutions. There has been a push to revive nuclear power initiatives, including restarting former reactors and investing in hybrid systems.

- Surge in electricity demand for AI.

- Focus on reliable and clean nuclear energy sources.

Investment Background

TAE Technologies has successfully raised over $1.3 billion from notable investors like Google and Goldman Sachs. In contrast, Trump Media has faced financial challenges, reporting significant losses since its inception. In Q3, the firm reported a loss of $54.8 million.

This merger illustrates a transformative step for Trump Media as it shifts focus from social media to the energy sector, aiming to establish a foothold in innovative fusion technology.