AI Surge Triggers Debt Increase in Safest Market: Credit Weekly

The surge in artificial intelligence (AI) investment in the United States has prompted a significant increase in corporate borrowing, particularly within the utility sector. This reliance on credit markets for financing could alter the corporate bond landscape, traditionally viewed as a safe investment.

Debt Increase in the Utility Sector

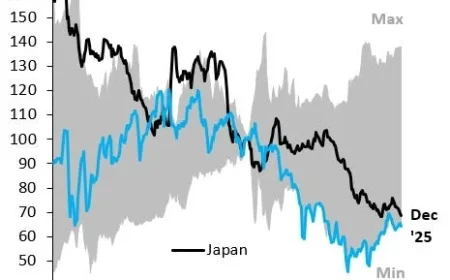

This year, utility bond sales surged by 19%, reaching a record $158 billion. This funding primarily caters to growing power demands fueled by the AI boom. Over the next five years, electric companies are anticipated to spend over $1.1 trillion on infrastructure developments, including power plants and substations, according to the Edison Electric Institute.

Financial Landscape for Utilities

Despite the surge in debt, investors are generally confident about the financial health of utility companies. The utility sector operates largely within a regulated environment that dictates pricing structures. Consequently, utilities usually refrain from initiating large projects until they secure regulatory approval to recover expenses.

However, the rising debt levels could introduce some risk to investors. JPMorgan Chase recently predicted an 8% increase in utility bond issuances in the coming year, citing ongoing investment in data centers and grid resilience initiatives.

Risks and Investor Sentiment

While the growth in utility investments signals potential profitability, concerns about an overheating AI sector persist. Should AI-related spending slow down, the narrative promoting utility growth could falter. Furthermore, with electricity prices having climbed by 5.1% in the year leading to September, public dissatisfaction may pressure regulators to keep rate hikes minimal, potentially affecting investor returns.

- Electricity Price Increase: 5.1% over the last year.

- Predicted Utility Bond Issuance Rise: 8% expected next year.

- Total Utility Spending on Infrastructure: Over $1.1 trillion projected over five years.

Investment Strategies

For bondholders seeking stability amidst these dynamics, investment in regulated utilities may offer better security. Analysts suggest that bonds issued by operating companies are backed by tangible assets, minimizing risks for bondholders.

In contrast, investments in holding companies may carry greater uncertainty, as demonstrated by recent bankruptcies in the sector. For example, PG&E Corp., a holding company, has faced bankruptcy twice in the past 25 years.

Market Responses

Despite the underlying risks, demand for utility bonds remains strong. Notably, a recent $1.15 billion bond sale by Florida Power & Light was five times oversubscribed, indicating robust investor interest. Similarly, Duke Energy and Evergy Inc. experienced significant demand for their recent offerings.

In conclusion, the AI surge is reshaping the credit landscape for utilities, introducing both opportunities and risks for investors. As the market evolves, careful monitoring of regulatory changes and economic conditions will be crucial for informed investment decisions.