“Explore the Iconic Design of the Down Arrow Button”

In recent discussions surrounding California’s proposed 2026 Billionaire Tax Act, perspectives vary widely among the state’s notable wealthy residents. While some billionaires express opposition to the wealth tax, others are advocating for the need for a fairer tax system.

Support for the 2026 Billionaire Tax Act

The 2026 Billionaire Tax Act aims to levy a one-time 5% tax on individuals with a net worth of at least $1 billion. This policy intends to generate approximately $100 billion in revenue, primarily for healthcare programs.

- 90% of the new revenue is designated for healthcare.

- The remaining funds will support education, food assistance, and tax administration.

Among the supporters is Dave Nixon, a former healthcare executive who moved to Pasadena in 2022. Nixon is part of the Patriotic Millionaires, a group advocating for equitable tax policies. He argues that California outperforms states like Florida in addressing critical societal issues such as education and healthcare.

Concerns Over Wealthy Residents Leaving California

Nixon has criticized the narrative that higher taxes will drive wealthy individuals away. In his view, this idea serves as a tactic by billionaires to resist tax increases. “California’s higher taxes are exactly what makes it the kind of state I want to live in,” he stated.

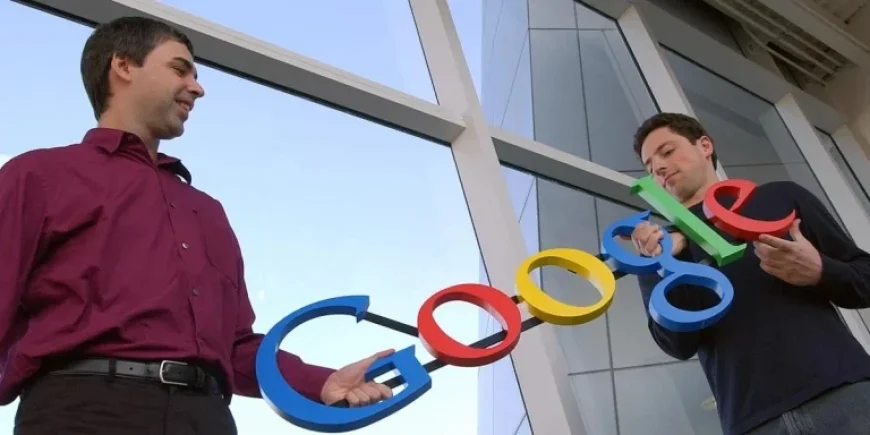

Some prominent billionaires have indicated their intent to leave California. Notable figures like Peter Thiel, along with Google’s founders Larry Page and Sergey Brin, are reportedly considering relocating to Florida. However, Nvidia CEO Jensen Huang has expressed no intention of departing the state due to tax concerns.

The Economic Impact of Healthcare Costs

Healthcare affordability is a critical issue in California. Maureen Kennedy, another member of the Patriotic Millionaires and a former federal housing official, emphasizes the necessity of tackling rising healthcare costs. She supports the rationale behind the new tax plan, which aims to fund essential services.

- Healthcare spending grew by 7.5% from 2022 to 2023.

- Wage growth during the same period was only 4.43%.

Experts predict a further 9% increase in healthcare costs by 2026 without intervention. This rise may significantly affect millions of Californians, especially as changes to MediCal coverage unfold.

Tax Rates Among the Wealthy

The disparity in tax contributions is concerning. Between 2018 and 2020, billionaires faced an average tax rate of only 24%, while the overall population contributed 30%. Top income earners were taxed at a considerably higher rate of 45%.

“American ethos is built on playing by the rules and paying your fair share,” Kennedy stated. The proposed 2026 Billionaire Tax Act aims to ensure the wealthiest residents contribute equitably to the state’s financial needs.