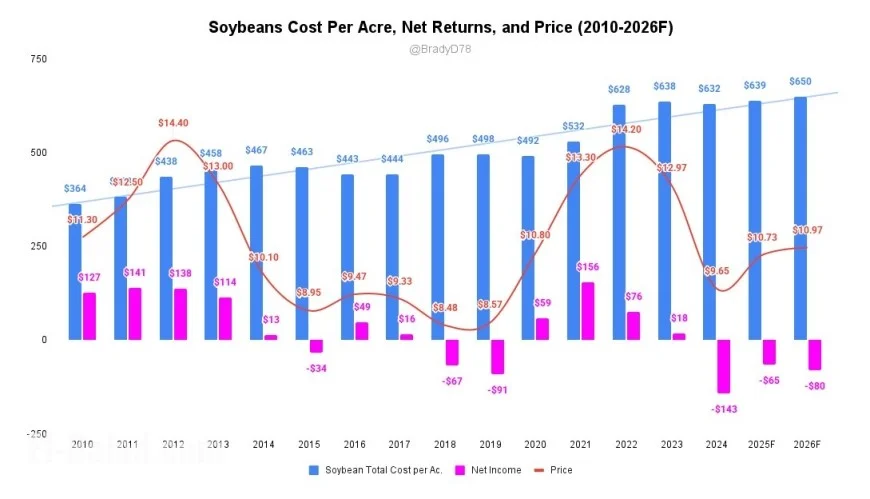

Soybean prices today: front-month slips as China “buy more” headlines lack detail; cash holds near $10.13/bu

Snapshot (Thu, Oct 30, 2025, AM ET)

-

CBOT soybeans (Nov ’25): trading around $10.65–$10.85/bu after an overnight drop; nearby months are modestly lower as well.

-

Spot/cash gauge (U.S. national avg.): roughly $10.13/bu.

-

Soy products: meal slightly softer; soyoil down ~0.6¢/lb in overnight action.

What’s moving the market

-

China headlines ≠ hard demand. Prices popped earlier this week on talk of larger Chinese purchases, then faded when new commitments lacked specifics; officials signaled intent to expand ag trade but gave no volumes or timing—keeping rallies in check.

-

Rumors vs. numbers. Separate commentary pegged potential buys this year in the low-teens million tons, but futures reaction suggests traders want confirmed sales flashes/export data before repricing.

-

Harvest + Brazil outlook. U.S. harvest progress and improving South American supply prospects temper upside, while meal/oil weakness adds pressure at the margin.

Levels & context traders are watching

-

Nearby price zone: CME quotes show Nov ’25 (ZSX5) hovering near 10.65/bu; a sustained push back above the $10.90–$11.00 area would signal momentum repair, while slips toward $10.50 risk a test of October’s average close band.

-

Volatility & ranges: Intraday swings have been wide (40¢+ ranges overnight were noted this week), reflecting headline risk around trade and macro.

What to watch next

-

USDA weekly export sales for confirmation of China/other demand flows.

-

Fresh policy signals from Washington–Beijing: without concrete tenders or tariff relief, rallies likely stall.

Soybeans are softer this morning as trade optimism cools; futures sit mid-$10s while U.S. cash averages hold near $10.13. Bulls need verified sales to China or weather hiccups in Brazil to drive a durable break higher; otherwise, harvest pressure and mixed product markets cap bounces.