Understanding Rising Insurance Premiums: What You Need to Know

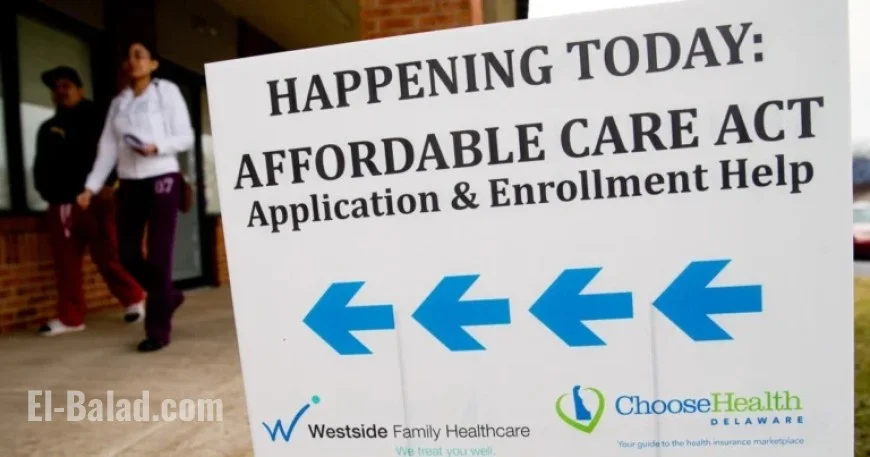

The upcoming open enrollment period for the Affordable Care Act (ACA) is set to start on November 1 and will last until January 15 in most states. This year, experts predict a significant hike in health insurance premiums, the largest since the ACA was established over ten years ago. Over 24 million Americans currently rely on the ACA, commonly referred to as Obamacare, for their health coverage.

Impact of Rising Premiums on Coverage

By 2026, many consumers may face substantial increases in insurance costs due to two main factors: the expiration of enhanced subsidies and rising insurance rates. Experts suggest that this situation could lead many to either seek less expensive plans or go without coverage altogether. Stacie Dusetzina, a health policy professor at Vanderbilt University, highlighted the difficult choices families face between essential expenses and insurance premiums.

Enrollment Period Details

The ACA open enrollment lasts from November 1 to January 15 across most states, with some exceptions:

- Idaho: October 15 – December 15

- Massachusetts: Until January 23

- Virginia: Until January 30

- California, New York, Rhode Island, Washington D.C.: Until January 31

To have coverage begin on January 1, individuals must enroll by December 15. Plans selected after this date will typically go into effect on February 1. A recent change means that lower-income individuals previously allowed to enroll year-round will now face the same restrictions as other groups, starting from August 25, following concerns raised by insurers.

Reasons Behind Premium Increases

Two significant factors are contributing to this year’s premium increases:

- The end of enhanced ACA subsidies

- Increased rates set by insurers

Enhanced subsidies introduced in 2021 were critical in helping many middle-class families manage their costs. If these subsidies expire, average premiums could rise significantly, with estimates suggesting a potential increase of over 114% for some enrollees.

Eligibility for Enhanced Subsidies

Prior to 2021, ACA subsidies were available only to individuals earning up to 400% of the federal poverty level. The enhancements raised this threshold and increased the amount of assistance provided. Currently, about 22.3 million ACA recipients benefit from these subsidies, which play a vital role in making healthcare affordable for many.

Consequences of Removing Enhanced Subsidies

The Congressional Budget Office forecasts that approximately 3.8 million people may lose their coverage and become uninsured annually over the next eight years if enhanced subsidies are not extended. Those who retain their policies can expect to pay significantly more for premiums. For instance, a couple aged 60 earning $85,000 per year could see their monthly premiums jump from about $600 to approximately $2,600.

Alternative Options for Coverage

For those earning below four times the federal poverty level, standard ACA subsidies remain available, but their value will be reduced, leading to higher premiums. People who previously qualified for plans with no monthly premium might also lose that benefit.

Switching from more comprehensive plans to bronze plans, which entail lower monthly premiums but higher deductibles, could offer some relief. Nevertheless, careful evaluation of coverage details is advisable, as costs can accumulate quickly. Experts advocate planning for worst-case scenarios, emphasizing the unpredictable nature of healthcare expenses.

Considering Insurance Alternatives

Some individuals are contemplating dropping health insurance altogether. While paying cash for smaller medical expenses may seem financially viable, experts warn against this strategy. Serious medical incidents, including hospital stays or surgeries, can lead to exorbitant costs without insurance coverage.

For those uninsured, federally qualified health centers offer affordable primary care, although upfront payments are often required. Additionally, community-based self-insurance co-ops may provide lower premiums, though they lack ACA regulation and could potentially expose members to unexpected financial burdens.