BofA Declares End Of Stock Cuts; Focus Shifts To 2025 Fail Risks

The financial landscape is shifting as Bank of America (BofA) declares the conclusion of stock cuts, leading to a renewed focus on potential risks for 2025. Recent market activities have shown volatility, prompting a reevaluation of investor strategies and sentiments.

Market Reactions to Recent Developments

Futures for the Nasdaq 100 and the S&P 500 showed a positive trend this morning ahead of the New York market opening. This suggests that traders believe the preceding day’s market declines were excessive. On the previous day, the S&P 500 experienced a loss of nearly one percent, while the Nasdaq fell by 1.47%.

Major Tech Companies Under Scrutiny

Investor focus has shifted to AI spending announcements from major tech firms, including Meta, Microsoft, Alphabet, and Amazon. While Amazon reported a substantial 13% increase in post-market trading attributed to robust cloud revenue, Meta’s shares plummeted by 11.33% following plans to issue $30 billion in bonds to fund $72 billion for capital expenditures focused on AI and data infrastructure.

- Meta: -11.33% following bond issuance for AI spending.

- Amazon: +13% post-market due to strong cloud revenues.

- Microsoft: -2.9% due to higher-than-expected AI expenditures.

- Nvidia: -2% following AI spending concerns.

Traditionally, these tech giants have financed AI investments through cash reserves, but current market conditions are prompting them to incur debt, leading to investor trepidation. Analysts have expressed concerns over the potential returns from such expenditures, particularly given Meta’s low revenue-to-capex ratio of 3.02.

Federal Reserve and Interest Rate Predictions

Market analysts are rethinking their expectations regarding interest rate adjustments from the Federal Reserve. Fed Chair Jerome Powell’s recent remarks were more pessimistic than anticipated, indicating a potential pause in rate cuts. While 66% of analysts still foresee a December cut, a significant 33% predict that rates will not be lowered, reflecting unusual market uncertainty.

BofA’s Insights on Future Cuts

BofA analysts Claudio Irigoyen and Antonio Gabriel contend that the current environment marks the conclusion of rate cuts from major central banks. They predict that the Fed and the Bank of Canada will likely pause after their last cut. According to their projections:

- 2025 Easing Season: The end of cuts for several developed economies.

- European Central Bank: No immediate cuts anticipated, with the next expected in March.

- Bank of England: Expected to maintain current rates next week without forecasted cuts until March.

- Reserve Bank of Australia: Anticipated to hold rates steady for an extended period.

Investor Concerns: ‘Fail Risks’

Amidst uncertainties, BofA’s monthly fund manager survey highlights significant investor concerns for the future. Half of the respondents cited a “disorderly rise in bond yields due to debt fears” as their primary risk, while 30% pointed to trade tensions as another major worry.

Market Overview

As markets prepare for today, here are some key indicators:

- S&P 500 Futures: Up 0.72%, after closing down 0.99% the previous session.

- STOXX Europe 600: Down 0.24% in early trading.

- FTSE 100 (UK): Down 0.42% in early trading.

- Nikkei 225 (Japan): Up 2.12%.

- CSI 300 (China): Down 1.47%.

- KOSPI (South Korea): Up 0.5%.

- NIFTY 50 (India): Down 0.5%.

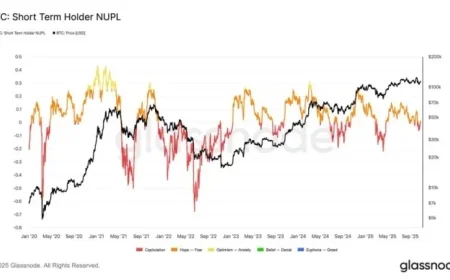

- Bitcoin: Flat at $110K.

The convergence of these factors suggests that while the stock cuts may be over, the focus has now shifted toward managing the risks associated with upcoming economic conditions.