$88K Offer Available Now

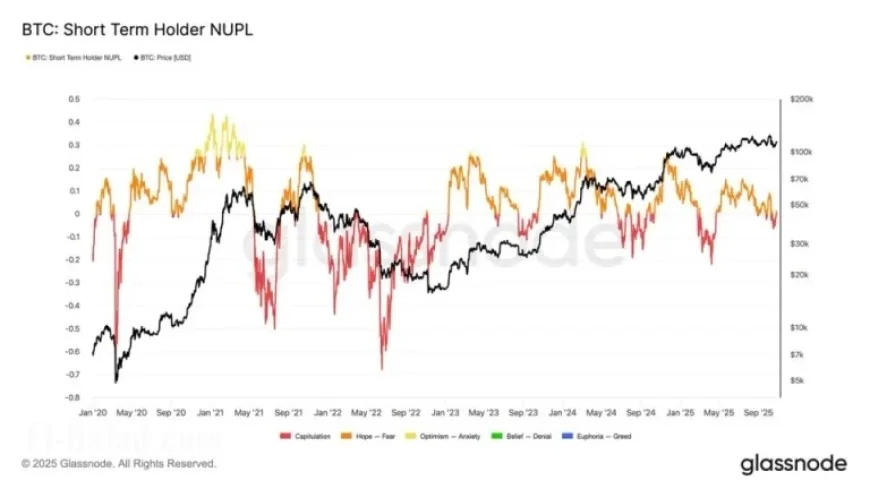

Bitcoin’s recent performance has not been promising, with its price fluctuating between $100,000 and $120,000 throughout much of 2025. Presently, it trades at approximately $109,562.43. Analysts at Glassnode are growing concerned about this trend, particularly as Bitcoin struggles to meet the $113,000 short-term holder cost basis.

$88K Offer Available Now: Key Support Level

The $113,000 mark is crucial for maintaining a bull market. However, despite several attempts to recover this threshold, Bitcoin has repeatedly fallen short. According to Glassnode, if Bitcoin’s price declines further, it may drop to $88,000, which is a significant support level. This price point corresponds to the realized price for active investors, indicating a potential deeper correction.

Investor Sentiment and Market Dynamics

Investor sentiment is increasingly strained. Short-term holders are currently facing losses, with the Short-Term Holder Net Unrealized Profit/Loss (STH-NUPL) at –0.05 as Bitcoin hovers around $107,000. While this doesn’t indicate full capitulation, it underscores a decline in confidence among investors.

- Short-term Holder Sales: Increased selling at a loss.

- Long-term Holder Activity: The Long-Term Holder Net Position Change has decreased by 104,000 BTC this month, the largest distribution wave since July.

Glassnode highlights that unless long-term holders resume accumulation rather than selling, a price rebound will likely remain difficult. The derivatives market appears more stable following the October liquidation crisis, with realized volatility reduced to about 43%.

Market Outlook

The one-week options skew, which had surged above 20% during the October volatility, has now returned to a neutral position. Overall, Bitcoin is entering a consolidation phase post-October’s turmoil. While the immediate panic may have subsided, the road to recovery hinges on renewed investor confidence and demand.

As of now, Bitcoin is trading just below $107,000, reflecting a 4% decline in the last 24 hours. The market’s direction will significantly depend on the sentiment shifts among both short-term and long-term investors as we approach critical support levels.