Trump Damps Nvidia’s China Hopes, Halting $5 Trillion AI Rally

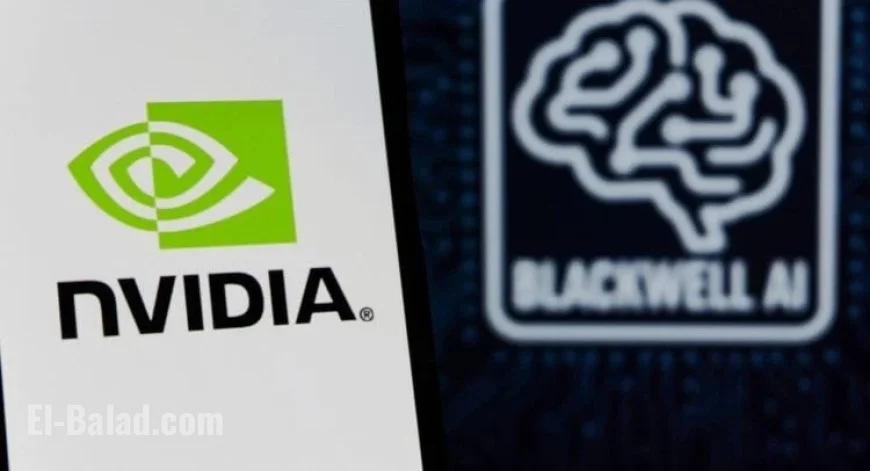

Recent comments from U.S. President Donald Trump have dampened expectations regarding Nvidia’s chip sales to China. Trump clarified that he did not discuss the approval of sales of the company’s Blackwell chips during his recent meeting with Chinese President Xi Jinping.

Impact on Nvidia’s Market Value

This statement has cooled speculation that Nvidia might soon gain access to the world’s largest chip market. Earlier, investors had briefly rallied around Nvidia’s stock, driven by hopes for a policy shift permitting the export of advanced AI chips to China.

Details from the Presidential Meeting

- President Trump and President Xi discussed Nvidia’s general access to China.

- Trump stated that U.S.-China discussions on Nvidia would continue independently.

- When questioned about downgraded Blackwell chips, Trump emphasized, “not talking about the Blackwell.”

Nvidia’s Position in the Semiconductor Market

Nvidia recently celebrated a milestone, becoming the first company to achieve a market value of $5 trillion. However, U.S. restrictions on the sale of advanced processors to China have limited Nvidia’s potential in this key market. These export limitations have driven some Chinese companies to seek support from local suppliers, such as Huawei Technologies.

China’s Role in Nvidia’s Revenue

Although Nvidia still derives revenue from China, growth in this region is slowing compared to the U.S. and Taiwan. The evolving landscape of export policies and local competition adds challenges for the company. Nvidia’s Chief Executive Officer, Jensen Huang, has noted that tighter restrictions could accelerate the growth of China’s own chipmakers.

Future Outlook for Nvidia

Despite these challenges, Nvidia remains a leader in the global AI chip market, with a strong focus on data centers across the U.S. and other pivotal regions. The possibility of shipping Blackwell chips to China seems remote for now.

Investment Sentiment

The investment community continues to view Nvidia positively. The stock holds a Strong Buy consensus rating from analysts. The average price target for NVDA is set at $231.34, suggesting a potential upside of 11.74% from its current price level.

As trade negotiations between Washington and Beijing progress, Nvidia’s growth trajectory depends largely on ongoing global demand for AI hardware.