Elon Musk’s Vote Could Decide His Trillionaire Status or Tesla Exit

Tesla’s upcoming annual meeting could significantly impact Elon Musk’s financial future. Shareholders will vote on a new compensation package that may solidify Musk as the first trillionaire.

Musk’s Pay Package Explained

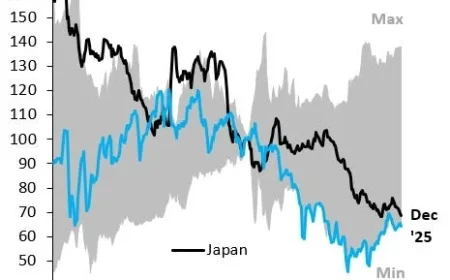

The proposed compensation includes a stock grant of up to 423.7 million shares over the next ten years. This package hinges on Tesla achieving a market capitalization of $8.5 trillion, representing a 466% increase from its current value. Should this goal be realized, the shares could collectively be worth approximately $1 trillion, boosting Musk’s wealth substantially.

Financial Challenges Ahead

Despite positive expectations, Tesla faces several financial hurdles. The company has reported declining sales and profits in the first half of 2023. Additionally, the reduction of U.S. government support for electric vehicles poses further challenges.

Future Business Focus

Musk and Tesla executives aim to pivot from just electric vehicle sales to a greater focus on autonomous driving technologies. This strategy includes plans for a fleet of “robotaxis” and the development of humanoid robots. However, these initiatives are still in the conceptual phase and have not yet been released to the market.

Shareholder Sentiment

Wall Street analysts express optimism about Tesla’s potential to meet its ambitious targets. Dan Ives from Wedbush Securities stated that shareholders are likely to support Musk, whom he views as essential for driving Tesla’s future in autonomous driving.

- 84% of Tesla shares approved Musk’s previous pay package.

- Critics question the fairness of the massive compensation on a daily basis.

Controversy Surrounding the Vote

Many investment funds have publicly opposed Musk’s pay package, including Norway’s Norges Bank Investment Management. Several U.S. public pension funds have also urged shareholders to vote against it. Influential advisory firms like Glass Lewis and ISS recommended a no vote, citing concerns about the vague performance metrics tied to the package.

Musk has publicly criticized these firms, calling them “corporate terrorists.” He believes that securing a substantial pay package is essential for him to maintain influence within Tesla, ensuring he can navigate the company toward achieving its future goals.

Conclusion

The outcome of this vote could determine not only Musk’s future status as the world’s first trillionaire but also the direction Tesla takes in the competitive automotive industry. Observers are eager to see how the shareholders will respond to this high-stakes proposal.