AMD Shares Fall Despite Strong Q3 Performance

Advanced Micro Devices (AMD) reported strong financial results for the third quarter of 2023, surpassing Wall Street expectations. However, despite this impressive performance, AMD shares fell in after-hours trading.

Q3 Earnings Overview

In the September quarter, AMD achieved an adjusted earnings per share of $1.20, with total sales reaching $9.25 billion. Analysts had projected earnings of $1.17 per share and sales of $8.76 billion, indicating a substantial beat on both fronts.

- Earnings Growth: Year-over-year earnings rose by 30%.

- Sales Increase: Overall revenue increased by 36% compared to the previous year.

Fourth Quarter Guidance

Looking ahead, AMD forecasted sales of $9.6 billion for the current quarter, ahead of Wall Street’s estimate of $9.21 billion. In the same period last year, AMD recorded revenue of $7.66 billion. CEO Lisa Su emphasized the broad demand for AMD’s high-performance processors, stating, “We delivered an outstanding quarter with record revenue and profitability.”

Revenue Breakdown

AMD’s revenue growth can be attributed primarily to its PC and gaming chip division, which saw a remarkable 73% increase year over year, generating $4 billion. Conversely, the data center segment also performed well, with revenue climbing 22% to $4.3 billion. Nevertheless, revenue for the embedded chips segment experienced an 8% decline, totaling $857 million.

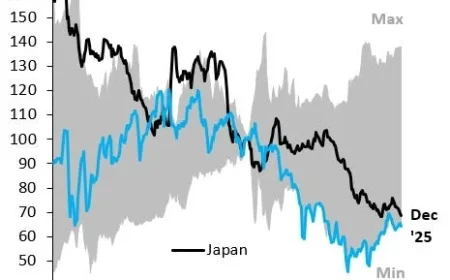

Stock Market Reaction

Despite the strong earnings report, AMD’s stock recorded a slight decline. In after-hours trading, shares fell nearly 1% to $248.24. During the regular trading session, shares dropped 3.7%, closing at $250.05. Notably, AMD reached a record high of $267.08 on October 29.

AI Market Dynamics

A significant driver for AMD’s recent performance has been its involvement in the artificial intelligence sector. The company secured notable partnerships for AI chips with major players, including Oracle, OpenAI, Zyphra, and the U.S. Department of Energy. AMD faces competition from companies like Nvidia and Broadcom in this rapidly growing market.

AMD maintains its presence on the IBD Tech Leaders list, highlighting its position within the technology sector. Investors continue to monitor the company’s growth trajectory as it leverages its expanding compute franchise and scaling data center AI business.